the october 2024 list

oh how i love being a scorpio despite october consistently being my worst month year after year

october’s favorites: scalding hot water pouring onto my body post-pickleball workout, my hair after it’s been conditioned in the shower and post leave-in, sleeping after a good cry

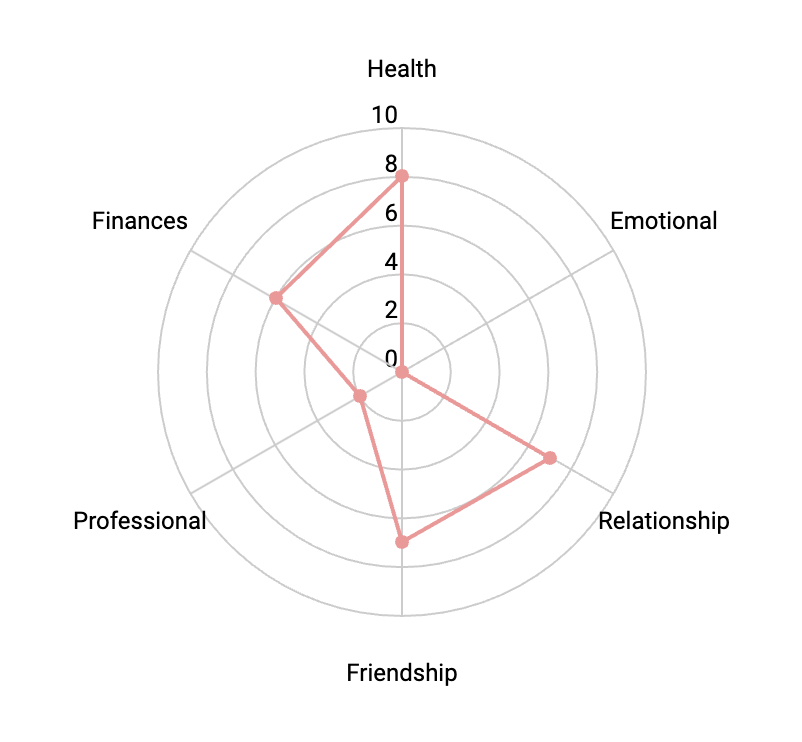

The Wheel Of Life is a self-assessment tool that breaks down different areas of your life and meausres the strength of each, on a scale of 1 (worst) to 10 (best).

My birthday month didn’t treat me well, yielding an average score of 5.0. Here’s why:

Health (8) — It’s always a good month if I didn’t have to go to the doctor’s office for something concerning. I’ve been cooking regularly, playing pickleball at most twice a week (something we still need to work on but it is exhausting!), and managing my yeast infection.

Emotional (0) — While rating this as 0 might be a bit dramatic, I couldn’t stop crying this month. Not the good type of crying either. After my PI yelling at me for not doing good enough work, my car breaking down in the parking lot of a mall (luckily the security team there was able to jumpstart my car), and dealing with an existential crisis on my birthday, and having depressive episodes throughout the month, I think this might be one of the worst months this year (aside from February).

Relationship (7) — Due to how emotionally turbulent this month was, external events affected my relationship with Mr. Beans, and I found myself easily irritable and angered. Thankfully, after our break, we learned to be better at communicating no matter how uncomfortable it may be in the moment. Mr. Beans giving me a safe space to vocalize my needs and issues helped a lot.

Friendship (7) — I got to call Bumble Beans a few times this month, met up with Egg, and spent an afternoon with Mr. Beans’ friends from college. What would’ve made this score higher was if I actually got to hang out with Bumble Beans in-person!

Professional (2) — As mentioned in Emotional and in Report Card 11, I began to really hate my job. I’m still trying to ride the wave, as applying to jobs in this economy is rough. However, the one thing I willfully changed was my attitude towards my job (my life doesn’t depend on it) and the way I carry myself around my PI (less fear, more if-you-yell-at-me-make-sure-you’re-hydrating-sis).

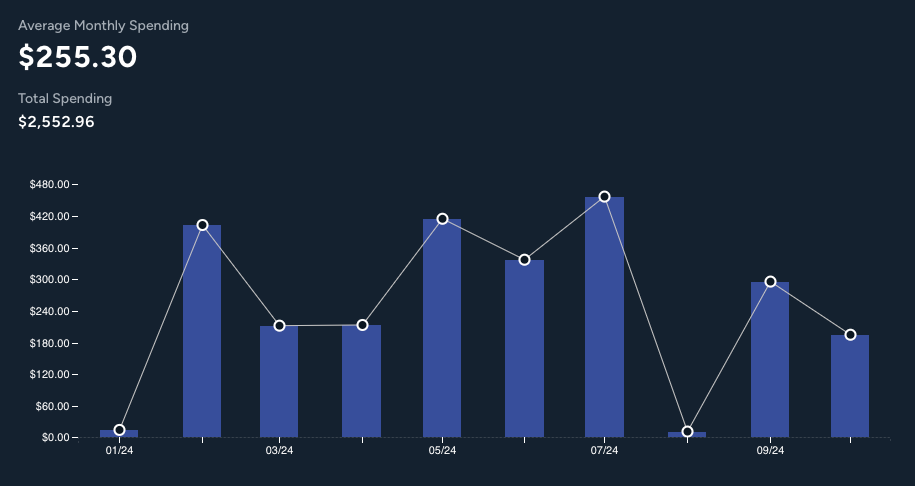

A detailed overview of my income sources, mandatory expenses, non-essential expenses, and savings/investments. I use YNAB, a budgeting tool that allows me to budget with the money I already have, instead of what I plan to make. This section does not contain any financial advice; please do research on your own prior to making any investment-related decisions.

Net Worth: $157,346.60 | last month: +$5,665.97

Income: +$4,062.54

Mid-month, my networth hit $160,000 and I was eagerly anticipating being able to report this. Alas, I can’t predict the ups and downs of the market — it is what it is!

Substack ($43.64): If you are a paid subscriber, you have my entire heart.

HYSA Interest ($106.31): Despite adding around $1,500 into this account, Wealthfront sadly announced a 0.5% decrease for their Cash Accounts (which is what I have). Regardless, Wealthfront is the GOAT and has one of the highest APY for HYSAs (higher than Ally and SoFi). Feel free to use my link for an additional 0.5% to the current APY.

9-5 Paycheck ($3,876.59): My gross yearly salary is $76,814, and I work in academia as a staff researcher.

Upwork ($36.00): I accepted a job last month doing some light research copyediting, and made $40 as a gross amount from it.

Perishable Expenses: -$2,039.00

“Perishable” expenses significantly impact my ability to comfortably live my life. So yes, I will “perish” (and yes, I get that this is an overstatement but I am a dramatic woman) without budgeting for these expenses. These are ordered from first to last by importance.

Rent ($1462.80): I split rent with Mr. Beans each month. He pays $2,300, and I pay the remaining balance. He generously covers utilities, including electricity, water, trash, trash valet, parking, and any pesky fees that get added to our bill. I recently posted about how Mr. Beans and I split expenses.

Health ($107.74): Got some boric acid suppositories (works wonders for yeast infections) and paid off a urinalysis/vag swab bill from seeing the gyno last month. I used $75 from this budget category to pay off part of my ear infection bill, as the rest was paid off using my emergency fund.

Groceries ($276.27): Under budget! However, I have to attribute the low spend to having gone home one weekend (free meals galore), getting lunch with parents, and dinner with cousins (she was kind enough to give me the leftovers).

Gas ($46.81): I hate filling up gas. Period.

Therapy ($145.38): Because I’ve hit my hefty insurance deductible of $3,000, my insurance plan is covering 80% of my sessions.

Privileged Expenses: -$194.85

These are items that, with my privilege, I am gratefully able to afford them. They impact my life positively, but not to the point where I would “perish” if I didn’t have them. These are ordered from first to last by importance.

Spotify ($16.99): I’m the main subscriber on a family plan with a group of friends.

Maintenance ($129.14): Got Dirty Labs sustainable laundry starter set, Ouai body wash, hydrogen peroxide, isopropyl alcohol, Sensodyne toothpaste, Listerine mouth wash, dish sponges, If You Care gloves, and Koala Eco dish soap.

Sunsama ($20.00): Surprised at how great this app is for to-do lists.

Me Time ($20.47): Purchased a book (as part of an event ticket) for a book signing for Jessica Joyce’s The Ex Vows at Smitten Bookstore.

Dates ($0): Mr. Beans kindly paid for all of our dates.

Social ($8.25): I was quite social this month! We did get takeout one of the times but my friend covered my meal for my birthday. I spent the $8 on coffee from Erewhon and parking.

Future: -$573.85

Future funds are pots of money set aside for certain purposes. I will not be showing the amount of money I allocate to these funds, because it would be a headache to report. Instead, I will only show sinking funds that I’ve spent money in.

Emergency ($573.85): Part of this went to covering the rest of my ear infection bill, and the other was for my car battery (can’t believe these cost around $300).

Rich Life: -$638.49

Rich life expenses are nice to have, but by no means necessary.

27th Birthday ($638.49): For a detailed breakdown of everything I purchased, see here! It definitely exceeded by budget of $300, but I’m not mad about it.

Retirement: +$1,386.32

I only display my net, not gross income, so the amount in Pre-Tax Investments do not make up any part of the Income amount.

401A ($886.32): My employer contributed $472.70 (8% match) while I contributed $413.62. Both are pre-tax.

403B ($500): This is a post-tax contribution.

Relevant Links: Low (Intentional) Buy Rules and a Quarter 1 Update.

All purchases for my birthday were not categorized as non-essential (yes, this may be a point of contention for some reading this). Report Card 11 goes into detail with every item and justification for why I purchased them.

With that being said, other purchases made this month were not categorized as non-essential. I have purchased a total of 22 items this year, which puts me at a really good post considering rule #1 above.

This section contains things I’d like to start incorporating into my routine, things I need to stop doing because they are detrimental to my health or wellness in some sort of way, and things I’d like to keep up with throughout the next month.

START prioritizing my papers. I have two papers at work that have been in a bit of limbo for multiple reasons (e.g., lack of motivation, other priorities on the job). However, I know that getting these papers done will benefit me greatly, as the more publications, the better!

STOP baking desserts that are high in sugar. Rather, make healthier alternatives to satiate my sweet tooth post-meal.

CONTINUE cooking! In my last report card, I listed and reviewed every single recipe I tried. I’ve been keeping a running list in the Notes app, and it’s quite surprising to me how many recipes I’m actually able to attempt each month! Last month, it was 17.

I admire the discipline you have with spending your disposable income. I have a budget for how much I'm allowed to spend each month but fear that it's higher than necessary. Also, it's such a huge feat that you were able to have a six figures worth of net worth before starting your PhD program!