I don’t know about you all, but July was a fever dream. I can’t say I’m able to recall what happened, because most of it was spent indoors trying to stay as far away as possible from the debilitating Southern California heat. Mr. Beans, a native East Coaster, hates the summer here because he says it feels like he’s getting air fried in real time. We’re opposites in that the humidity during East Coast summers makes me feel like I’m perpetually wetting myself.

Enough about the weather. Let’s chat about July.

The Wheel Of Life is a self-assessment tool that breaks down different areas of your life and meausres the strength of each.

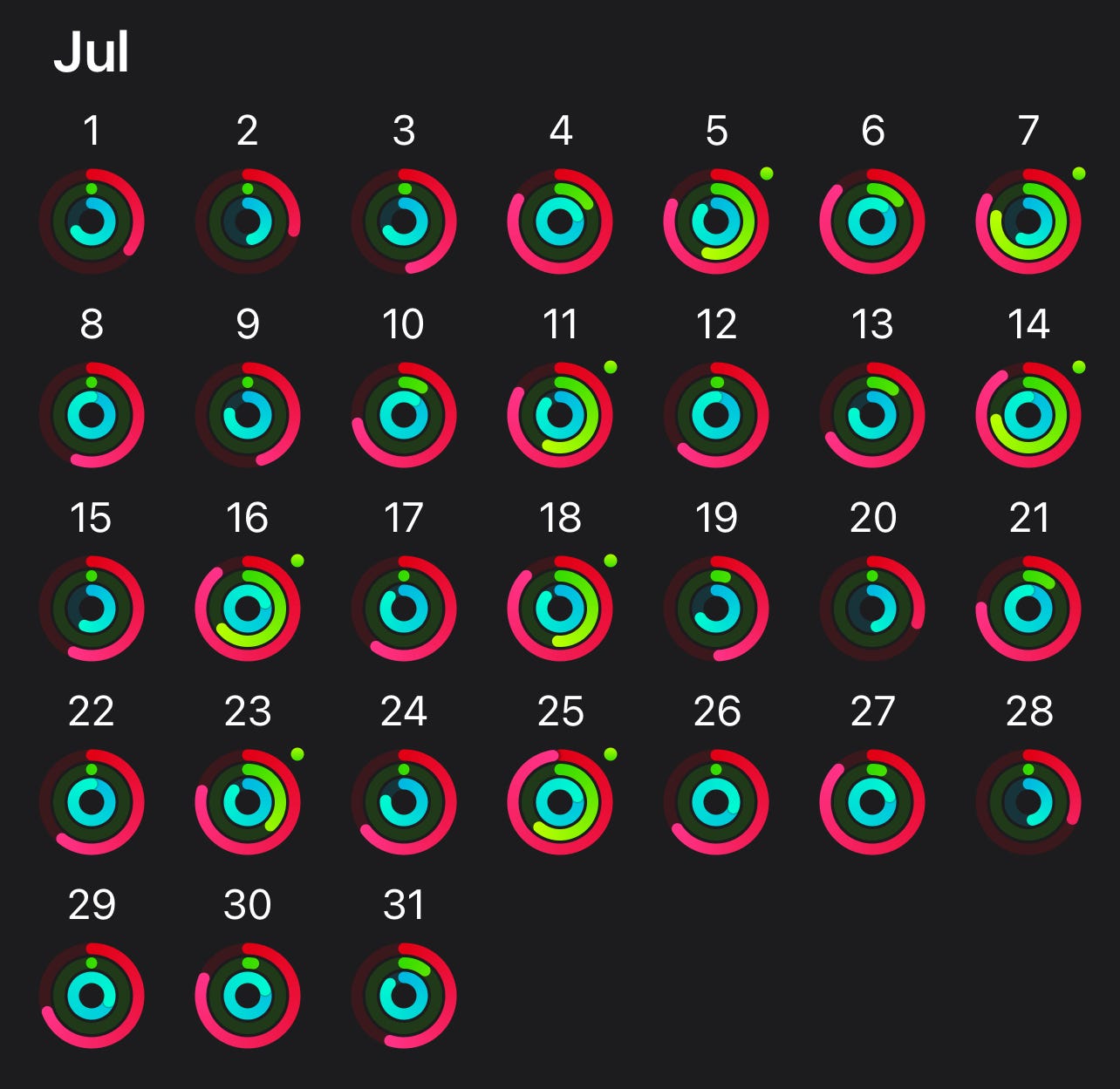

Physical 1/10 — Not proud that this score dropped significantly from last month. According to the Fitness app, I completed my move ring once. That’s entirely embarrassing, and not good for my body at all. I can’t even use COVID as an excuse since I recovered from that in early July.

Emotional 7/10 — No breakdowns. No messy arguments. But my therapist did say I’m showing signs of low grade depression.

Relationship 9/10 — Mr. Beans and I have been really good this month. We’ve set really healthy boundaries with each other and spend high quality time (over low quality time). Surprisingly, I stopped therapy sessions this month, so feeling strong in my relationship was a necessity.

Friendship 6/10 — I hung out with Bumble Beans once in-person and Facetimed her once. Despite feeling fulfilled in my friendships, I ended up not responding to Bumble Beans for a week or so, and she messaged me asking if she did anything wrong (she has anxious attachment and has been really great at communicating this with me). So despite feeling okay in my friendships, I could’ve been better at responding to her messages — hence, knocking off some points for this domain.

Professional 6/10 — I’m a bit conflicted about this one. On one hand, a paper that’s been under review for ages finally got published, so I’m currently at 9 publications. On the other hand, I’ve been lacking motivation at work. I’m not entirely sure what’s causing this, but I’ve been finding myself excessively cleaning or reading to avoid it.

Finances 3/10 — My maintenance category spend was absurd (see next section for the full breakdown). Despite July being a 3 paycheck month, I felt like I could’ve done better. I also Venmo’ed Bumble Beans $400 to cover a part of her loss for the Hawaii trip we were supposed to go on but cancelled because I caught COVID.

A detailed overview of my income sources, mandatory expenses, non-essential expenses, and savings/investments. I use YNAB, a budgeting tool that allows me to budget with the money I already have, instead of what I plan to make. This section does not contain any financial advice; please do research on your own prior to making any investment-related decisions.

Net Worth. $144,799.45 —

I finally rolled over my 401K and 403B from my previous job to Vanguard (where I have my Roth IRA and brokerage accounts). I was contacted by a company for a partnership opportunity, and truthfully, this is the first legitimate company to actually spark my interest. With that being said, now that all my money is in my Vanguard (with the exception of my current employer’s retirement accounts) and I am able to re-invest this into new funds, I chose pretty volatile ones since my Roth IRA investments are quite conservative. I chose VTFAX, MGK, VONG, and VTI allocated over around $26,000. Despite the market dipping a bit at this moment (with my overall net change being in the negatives), I’ve learned to stop getting overly anxious about this. After all, money in these accounts is there to stay for the long-run.

Income. +$5,158.72 —

9-5 Job ($5,032.74): Cheers to a three paycheck month! For context, my gross yearly salary is $76,814 (annual increase by $2,814—if you’re laughing at how small this number is, I am too). Funnily enough, I wasn’t expecting a raise despite working here for a year, but suffice to say I was surprised by a tiny smidge of a difference in my second paycheck when it hit my account. I do academic research at a university and my main goal out of this job is to publish as many academic papers as possible so I could get into my ~dream~ PhD program. I am currently enrolled in my university’s free PPO high deductible (which I’ve already met, I might add) health insurance plan. Everything else is covered by the university (dental, vision, life/disability).

FB Marketplace ($60): I sold Mr. Bean’s Kindle case that he never used (still in packaging, brand new) for $10 and his desk, which originally paid $700 for, for $50.

Substack ($24.96): Genuinely surprised that I still have paying subscribers despite taking a break from my usual Substack schedule. Thank you! I love you!

Interest ($0): Last month, I received July’s interest payment so that’s why I didn’t get one this month. I use Wealthfront, for those who are curious.

Perishable Expenses. -$2,347.41 —

“Perishable” expenses are those that will significantly impact my ability to live my life in any way shape of form. So yes, I will “perish” (and yes, I get that this is an overstatement but I am a dramatic woman) without budgeting for these expenses. These are ordered from first to last by importance.

Rent (-$1,431.29): I split rent with Mr. Beans each month. He pays $2,300, and I pay the remaining balance. Do note that he covers utilities, including electricity, water, trash, trash valet, parking, and any pesky fees that get added to our bill.

Health (-$378.36): Venmoed back Mr. Beans for the COVID tests he got me last month, paid off a portion of my ER bill from my ear piercing ($184.93), got an eye exam done ($10), restocked on melatonin ($4.41 for 60 capsules from Life Extension), and restocked on my anti-depressants ($25.24 for 90 pills).

Groceries (-$118.05): Oh joy! In last month’s list, I wrote this under the groceries category:

I definitely could have cut my spending down to $150 this month, but perhaps I’ll make it a challenge for next month!

And heck yeah, I spent less than $150! A big part of this was 1) only shopping at farmers markets every Saturday — I don’t buy a lot because I have to carry it on my shoulder, so I only buy what I actually need and will cook; 2) my parents gave me food to eat when I met them twice this month, totaling around 10 free meals; and 3) I didn’t go to an actual grocery store, and this helped tremendously because I am always tempted by weird vegan junk food. A big portion of this grocery spend was my San & Wolves Bakeshop haul from Mayumi Market. I’ve been wanting to try their baked goods for the longest time and I’m so glad I did! Their vegan blueberry bibingkas are phenomenal. The $120-$150 range for groceries is an excellent spot to be, and I’m hoping to be consistent with this from now on.

Gas (-$44.17): I drove one of the weekends to stay at my parent’s house, so a gas fill was needed.

Therapy (-$375.54): I tried seeing a new therapist this month and it failed miserably. The provider I saw was actually so terrible — despite being Asian American and having a PhD, she actually made my anxiety-ridden self cut the session short because all the provider did was repeat everything I told her, question my decisions, and tell me “it’s your decision” at least 10 times in the span of 30 minutes. I had to see my usual therapist after this monstrosity of a session. I usually pay $165 for 45 minutes, but she doesn’t offer that anymore. I’ve agreed to do $210 for 1 hour, and it’s actually much better (mental health wise, not so much money wise).

Privileged Expenses. -$568.78 —

These are items I consider as those who have privilege being able to afford them. They benefit my life significantly, but not to the point where I would perish if I didn’t have them. These are ordered from first to last by importance.

Spotify (-$16.99): Thanks to a lovely subscriber, I learned that to keep the $16.99 monthly cost, I have to go in and manually change the plan from Premium Family (costs $19.99/month) to Basic Family (costs $16.99/month). I believe Basic doesn’t give access to audiobooks?

Maintenance (-$411.65): Ironic looking at how high this spend was despite doing Plastic Free July (PFJ) last month. Most of these items were meant to alleviate some of the burdens of PFJ. I will be writing a Substack post, going into detail about every single item listed here and whether I recommend it or not. Disregarding returns, I purchased from the following companies: Stojo, Biom, Rhinoshield, Saalt, Bite, Earlywood, and my local refill shop.

Sunsama (-$20): My go-to app for my to-do list.

Me Time (-$19.71): A new category! I’ve found myself going to events by myself lately, and wanted to dedicate a portion of my privileged budget to this. At Mayumi Market, I ordered Lucky Catsu’s Lucky Catsu plate, and I can’t even begin to tell you how I transcended into another universe after taking my first bite. This was heavenly. I haven’t had Hawaiian food since I became vegan in 2016, so it felt like I was catching up on lost years of not having Hawaiian food. If you are based in SoCal and are vegan (… or not!), please please please do yourself a favor and give Lucky Catsu a try, and be sure to let me know how much you loved it afterwards!

Dates with Mr. Beans (-$80.95): I was aiming to spend no more than $75 — oh well. I paid for lunch at my favorite Vietnamese restaurant, coffee for both of us, and musubis (just for me while he paid for his own food at the farmers market).

Social (-$19.49): What a win! I don’t remember spending this little in my social category, since every time I see Bumble Beans, we always go out for food (lunch + dinner) and grab a drink. When I saw her, I asked if I could bring food from home and only spend money on coffee. My entire social spend consisted of getting coffee twice — once with Bumble Beans and once with my parents.

Rich Life. -$400 —

Rich life expenses are nice to have, but by no means necessary.

Travel (-$400). Sadly, this expense wasn’t for flight tickets or a weekend getaway.

Future. +$1,977.84 —

Contributions to my Roth IRA and Emergency Fund are taken from my net monthly pay. I only display my net, not gross income, so the amount in Pre-Tax Investments do not make up any part of the Income amount.

Roth IRA ($0). I didn’t contribute this month because I wanted to get my finances back on track. Also, I am very close to maxing this out, so I wasn’t in any particular rush to top it off.

Emergency Fund (+$666.24): Slowly growing this fund…My current balance is at $19,010.34.

Pre-Tax Investments (+$1,311.60): This is not part of the Income total; therefore, I haven’t assigned a percentage next to the total amount. This amount decreased significantly from last month because I decided to stop contributing to my 403B in the meantime, while increasing my 401K contributions by a little bit. The reason being, I wanted more money to cushion my savings account. I’ve realized that aggressively putting money towards these retirement accounts caused me to stretch my budget so thin that it induced a level of unnecessary anxiety.

401K Employer Match (+$612.08): My employer gives me a 8% match.

401K Self-Contribution (+$699.52): I’ve decided to increase these contributions, while decreasing my 403B contributions.

I did a Quarter 1 review two months ago where I went through every item I purchased from January through March, and updated, amended, or removed my rules. Now, onto a better and more intentional Quarter 2!

this month’s intentions,

I was strict this month on making sure that I didn’t make any non-essential expenses and excitingly enough, this is the first month this year that I reached this goal! This is a big deal for me, considering how much I’ve struggled with buying non-essentials throughout the year.

this month’s non-essentials,

Nothing!

items and why they’re essential,

This section contains a bunch of items that are not a part of my non-essential list even though, to a third party looking in, it might seem very non-essential. Alas, these are my personal rules that apply to my life, and it’s important to keep myself accountable and honest. This is why I’ve chosen to share my rationale here.

Stojo containers and cups - I’ve been washing and reusing plastic tupperware containers that restaurants would give me after placing a to-go order, and while I had no issue with this for a while, something in my brain instigated the need to do research whether this could be harmful for my health. Unsurprisingly, a flood of papers on this topic surfaced after a quick Google Scholar search. If you’re interested, here’s a great article published in the Journal of Hazardous Materials. With that being said, I felt the urge to find containers that were lightweight (because I am a weak girl and carrying around glass tupperware everywhere I go would actually make me cry in public).

Saalt menstrual cup - Despite making a relatively large purchase of tampons and pads last month from Daye, I was convinced by a few direct messages I received regarding menstrual cups. The reason I stopped using a cup a year ago was because I realized I started getting UTIs from it. A bigger part of the issue was the fact that I only sterilized the cup once (boiled in hot water) over the course of two years. So yes, my laziness was the self-induced cause of a UTI. As an attempt to become more conscious about eliminating any means of unnecessary waste from my day to day life, I thought I’d give a menstrual cup a try again.

Earlywood spatulas - I posted an Instagram story that showed plastic spatulas Mr. Beans owned for over 2 years now that started chipping at the edges. Considering how microplastics are almost difficult to avoid, I sure can do my best to stay away from macroplastics, which would be embedded in my food if I kept using those spatulas. As a result, after scouring through Reddit’s r/BuyItForLife for the best of the best, the brand “Earlywood” was a frequently recommended choice. Even though I could have found something much cheaper and made of a non-plastic material, I wanted something that was heirloom quality, and if I could purchase an item that could last multiple generations, then sign! me! up!

This section contains things I’d like to start incorporating into my routine, things I need to stop doing because they are detrimental to my health or wellness in some sort of way, and things I’d like to keep up with throughout the next month.

Start going on walks, despite the mental block of laziness. This habit evaporated this month, and as a result, I’ve started to feel physically ill with the perception of my own physique.

Stop wasting so much time consuming the unimportant. Ever since taking a break from Substack, I’ve learned that I actually do have the time to pursue my hobbies — Substack included. In hopes of churning out higher quality, research oriented content, I’d like to stop consuming so much media and instead, create my own.

Continue being as eco-friendly as possible in my day to day life. I sometimes find myself obsessing over a certain lifestyle goal or challenge, and after a few weeks or months, the obsession goes away and finds another thing to latch upon. I’d like to shift my love for being an eco-minimalist as a more permanent over transitory period of my life. After all, there is no Planet B.

Thank you for tuning into this monthly list. I am so thankful to each and every one of you for taking the time to read my posts, as I pour my entire heart out into all of them. I’ve never once decided to publish something that isn’t my best work (excluding grammatical errors that I occasionally oversee), but I truly am so proud of what I’ve created on Bean’s Musings.

—Beans

Love your recaps! Congrats on 0 nonessential purchases!! 🎉

Thanks for the pro tip on the Spotify account update! I just updated mine to Family Basic.