Oh, what a month. An uncomfortably, unpleasant, and unrewarding month. I know that May was pretty meh for me, but I didn’t expect June to be that bad. I guess there’s always room for de-growth. This Substack has been my outlet for a lot of things this year, whether it be an excuse to avoid work, an excuse to avoid chores, an excuse to just delve into my self-indulgence and write without consequences. However, I didn’t set my boundaries in place, and let Substack take too much control over my life. If you ask me—how am I posting twice a week, consistently, and actually putting out content that looks like it takes tens of hours to complete? It’s because I’ve ignored other parts of my life just to keep my Substack running. It started as a passion project, maybe an overly passioned one, to one that’s consuming my day-to-day life, compromising the quality of work I output at my job. I’m not proud of it.

This isn’t my last Substack post, but I will be taking a short break from this platform to focus on how chaotic life behind the scenes is. I want to stop prioritizing Substack over what’s actually important in my life. The reality is—Substack is just a hobby for me, and it was never meant to replace my full-time job. With that being said, I can’t promise when the next newsletter will be—it will be sporadic, and I will no longer operate on a schedule anymore. However, I’m not completely saying goodbye to Beans’ Musings. I’ve put in way too much effort into these newsletters to let it collect metaphorical digital dust in a graveyard of other long-forgotten Substacks.

The Wheel Of Life is a self-assessemnt tool that breaks down different areas of your life and meausres the strength of each.

—PHYSICAL. 7/10. Mr. Beans and I have been going on regular walks after work. It’s the one thing I look forward to once my workday is over! I thought I would have to sacrifice time spent on hobbies, but I’d rather walk than watch a movie. Similar to last month, my period was unbearable to the point where I had to curl up fetal position on my couch after taking the rest of the day off. My body took a huge hit at the end of the month as a result of catching COVID and feeling all the symptoms—body aches, chills, headache, and sore throat.

—EMOTIONAL. 3/10. I accidentally flooded the kitchen as a result of my lack of mindfulness when filling up our Brita water pitcher. My PI reprimanded me for not doing something that I was never taught to do. I gave Mr. Beans COVID. Ultimately, I cried a lot.

—RELATIONSHIP. 5/10. We had a number of tough conversations this month, and while it’s been around a month since we got back together from going on a break, we still argue, and these arguments escalate. It’s not perfect. But we have been able to come back together in the end, which is the most important part of it all.

—FRIENDSHIP. 7/10. I spent quality time with Bumble Beans this month, and am so glad I spent that day early in June with her because the latter half of June would be spent quaratinining due to COVID. As a result, I didn’t spend much in my social category!

—PROFESSIONAL. 7/10. My colon cancer paper is still under review, and because we haven’t heard back from the publisher, we think we’ve passed the desk rejection stage? Fingers crossed.

—FINANCES. 0/10. I experienced a lot of financial anxiety this month. I’ve been trying to contest the ICD codes for my ear infection visits (yes, that bullshit is still going on). In addition, I caught COVID-19, which led to an onslaught of expenses, such as buying COVID at-home testing kits ($10/kit), take-out because I have no energy to cook, and worst of all, money lost from my Airbnb (they only refunded me $400 out of the $1,700) and flight tickets (waiting to see if they’ll reimburse me—I purchased insurance for this ticket).

An average of 4.5 is this month’s rating, such is 0.5 less than last month’s.

A detailed overview of my income sources, mandatory expenses, non-essential expenses, and savings/investments. I use YNAB, a budgeting tool that allows me to budget with the money I already have, instead of what I plan to make.

—NET WORTH.

In June, my net worth was $137,331.37. This was a $7,377.95 increase from last month’s net worth, which was $129,953.42.

Chase Checking Account: $419.31

Wealthfront Cash Account: $22,923.68

Vanguard Roth IRA: $51,334.23

Vanguard Brokerage: $7,871.41

Current Job’s 401K and 403B: $28,079.14

Previous Job’s 403B: $26,965.00

I’m not able to log into my 403B right now—seems like the website is down, so this number is most likely inaccurate.

—INCOME.

In June, my total income was $3,988.87.

9-5 Job ($2,867.39): For context, my gross yearly salary is $74,000, and I do academic research at a university. I am enrolled in my university’s free PPO health insurance plan. Everything else is covered by the university (dental, vision, life/disability).

FB Marketplace ($730): My highest resell month yet! This is mainly because I sold my two Thuma nightstands for $650, taking up a chunk of the proceeds for this category. I sold a total of 3 items this month.

Ebay: ($78.57): I sold 3 items this month, which is surprisingly good, considering I had no sales last month.

Substack ($51.32): My highest paying month! Thank you to all my new paid subscribers—you all mean the world to me.

Interest ($198.77): Received two interest payments for May and June this month. June’s interest is supposed to hit in July, which means next month I might not have an interest payment. I use Wealthfront for my HYSA (high yield savings account), where I’m getting 5.50% APY.

Deposit ($62.82): This is rather a dumb story that I hate to tell, but I closed one of my Chase checking accounts because I wanted to completely switch to Wealthfront. However, a lot of platforms, including Vanguard (where my Roth IRA is housed), aren’t able to connect to Wealthfront. Therefore, I had to re-open a Chase account. This $62.82 was the remaining balance from my first Chase checking that I closed.

—PERISHABLE EXPENSES.

“Perishable” expenses are those that will significantly impact my ability to live my life in any way shape of form. So yes, I will “perish” (and yes, I get that this is an overstatement but I am a dramatic woman) without budgeting for these expenses. These are ordered from first to last by importance. In June, my total perishable expenses amounted to $1,637.10 (40.7% of income).

Rent (-$1,414.08): I split rent with Mr. Beans each month. He pays $2,300, and I pay the remaining balance. Do note that he covers utilities, including electricity, water, trash, trash valet, parking, and any pesky fees that get added to our bill.

Health (-$30.24): This is going to be much more next month since Mr. Beans purchased all my COVID related expenses and I plan on Venmo-ing him back. This $30 was from a Doordash delivery since cooking was the last thing on my mind.

Groceries (-$192.78): Spending less than $200 on groceries is always a win, but I’m now realizing that even the smallest swaps count towards decreasing my grocery bill, whether it be having self-control to not buy snacks or frozen pre-made meals, or opting for the more expensive version of an item than the cheaper, store-branded one. I definitely could have cut my spending down to $150 this month, but perhaps I’ll make it a challenge for next month!

Gas (-$0): Parents kindly filled my gas tank up for me when I visited them for Father’s Day!

Therapy (-$0): I temporarily stopped sessions this month knowing that spending would be extremely high due to travel (or should I now say, cancellation of travel?).

—PRIVILEGED EXPENSES.

These are items I consider as those who have privilege being able to afford them. They benefit my life significantly, but not to the point where I would perish if I didn’t have them. These are ordered from first to last by importance. In June, my total privileged expenses amounted to $337.09 (8.3% of income).

Spotify (-$16.99): Sad that this is the last month the family plan will cost $16.99, because they’re raising it to $19.99 next month. Absolutely nuts.

Maintenance (-$159.29): Sustainable pads and tampons from Daye, recycled toilet paper and tissue boxes from Who Gives A Crap, and 3D printed soap dishes by ThingsbyJK.

Sunsama (-$20): My go-to app for my to-do list.

Dates with Mr. Beans (-$89.05): I wanted to decrease my budget for this month for dates to $75. I blew through majority of this budget after 2 weeks, so next month, I’m going to try to ration it out. I’m at least happy that this is significantly less than last month’s spend of $162.50!

Social (-$51.36): I purposely spent less this month and socialized way less because I thought my Hawaii expenses would blow it out of the water. Regardless, I’m glad I didn’t go overboard on this category.

Cushion (-$0.40): I mistakenly listed Mr. Beans’ item on Ebay for a much lower price than he wanted me to list it for, and when someone made a purchase, I had to cancel it. I believe I was charged 40 cents for this? I’m expecting Ebay to charge me more next month for this mistake because last time this happened, I had to pay a fee.

—FUTURE.

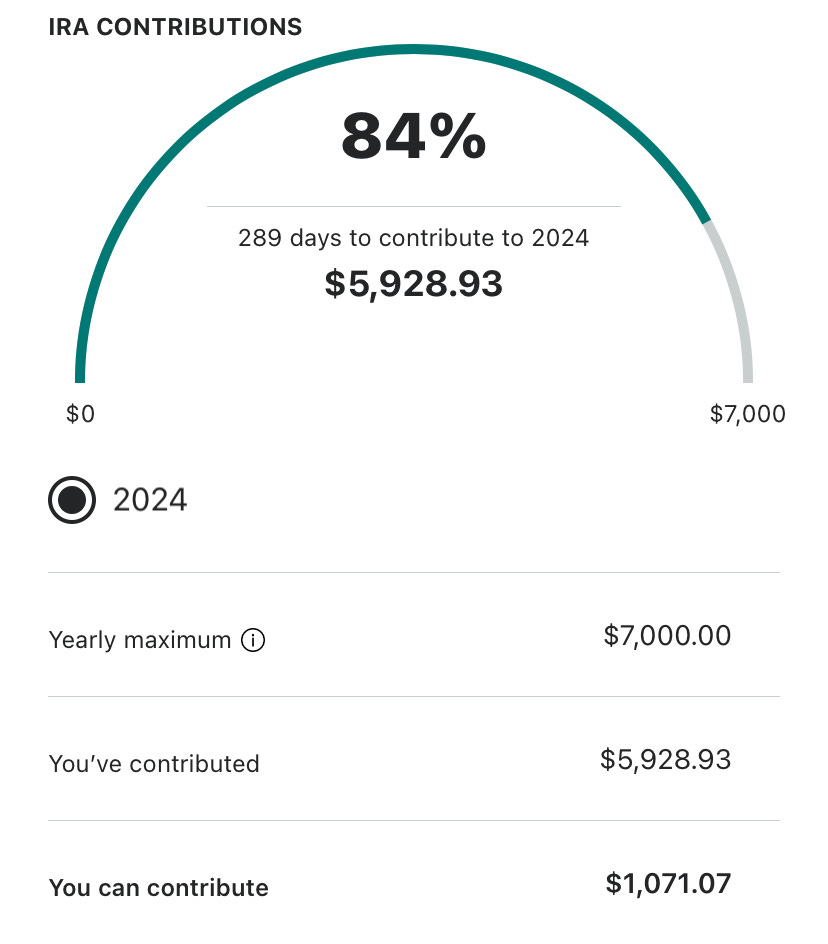

Contributions to my Roth IRA and Emergency Fund are taken from my net monthly pay. I saved/contributed a total of $3,698.84. I only display my net, not gross income, so the amount in Pre-Tax Investments do not make up any part of the Income amount.

Roth IRA (+$600). I’ve been trying to contribute $600/month, and for the past few months, I’ve been able to contribute a bit more than that. Hoping to max this account out in 2 months!

Emergency Fund (+$666.24): Slowly growing this fund…My current balance is at $18,334.10.

Pre-Tax Investments (+$2,432.60): This is not part of the Income total; therefore, I haven’t assigned a percentage next to the total amount.

401K Match (+$453.64): My employer gives me a 8% match.

401K Contributions (+$396.92): This is the amount I contribute.

403B Contributions (+$1,582.04): I’ve assigned 30% of my pre-tax paychecks to be allocated to this.

—RICH LIFE.

Rich life expenses are nice to have, but by no means necessary. In June, I “gained” a total of $379.79.

Home Decor (-$15): Purchased a nighstand on Marketplace that was way too big for my bedside area and has these weird hole-like indents on top. Terrible find, but it is what it is. I’m so bad at saying no to the buyer once I get there, especially after I negotiate—I need to get better at holding my ground! Even negotiating further if the quality doesn’t match what I expect.

Intentional Buy (-$34.33): I went to the 626 Night Market, for the sole purpose of purchasing TsundereSharks’ prints. I ended up getting a total of 5 (she had a deal where if you buy 4, you get 1 for free). I also traded these terrible pants I got on LuckySweater for a beautiful dress that I’ve been wearing non! stop!

Gifts (-$131.47): The entirety of this spend was for my dad for father’s day—all food related!

Travel (+$560.59): This is a weird balance because I actually lost money from not being able to go to my Hawaii trip. However, I made those purchases months ago, so the loss isn’t exactly reflected here. Mr. Beans’ friend refunded me money from a flight I purchased for him as an attempt to surprise Mr. Beans (it ended up not happening and we only got flight credit for this), and I got a $412.70 refund (out of $1700ish) for Airbnb. I purchased some Olukai sandals that I assigned to this category.

I did a Quarter 1 review two months ago where I went through every item I purchased from January through March, and updated, amended, or removed my rules. Now, onto a better and more intentional Quarter 2!

THIS MONTH’S INTENTIONS

Truthfully, I started this month wanting to do a no spend… and I broke it a few days in. In my mind, I kind of wanted to reel my spending in because of extraneous purchases I’d have to make for my (now cancelled) Hawaii trip.

NON-ESSENTIALS PURCHASED THIS MONTH

Shipping for Lucky Sweater ($4.54): Fun fact about this one—I made a terrible trade last month for these trousers, and ended up trading those trousers for a beautiful dress that I’ve already worn six times this month. Shipping costs do add up over time, but I am set on this dress and do not plan on trading it any further.

Tsundere Sharks Prints and Car Freshener ($29.79): I went to the 626 Night Market for the sole purpose of purchasing from Annie’s booth. I’m so happy with these prints, and they’re happy stuck to my wall. The car freshener is an adorable add to my “under-the-front-view-mirror” decor.

ITEMS AND THEIR JUSTIFICATIONS AS ESSENTIAL

Olukai Hila Sandals ($86.20): I first tried the Olukai ‘Ohana’s, and weirdly enough, the sandal felt like it was slipping off my feet. When I sized down, the straps were too tight. I was extremely disappointed, because I wanted these to work as I’ve heard incredible things about the brand. I took Mr. Beans shopping with me, and he convinced me to try the Hila’s, which I wouldn’t have even thought about if he weren’t there—they were so comfortable! So much more comfortable than the other sandals I tried on by the brand. The one thing to note is that there is a toe indentation on the base, perhaps my toes are lopsided because my toes don’t land perfectly within these indentations. Anyway, I’ve categorized these as “essentials”, because my current pair of flip flops are practically town in multiple places on the footbed. Also, whenever I get those in the water, it takes multiple days to dry, and I already feel nauseous about wearing wet flip flops all day. The only reason I kept these sandals were because I only use them to retrieve my mail downstairs or run a quick errand (that doesn’t involve extensive walking or driving). I took these Olukais out on a drive, and they were so comfortable! I still plan on keeping my current pair of flip flops until they get completely shredded into pieces, but my Olukais are the more versatile option when I want to wear it out to the beach or take it on vacation.

This section contains things I’d like to start incorporating into my routine, things I need to stop doing because they are detrimental to my health or wellness in some sort of way, and things I’d like to keep up with throughout the next month.

—START engaging in more sustainability-focused habits in my day to day life. I’ve made it a goal to do 3 big sustainable actions this month, and one of them involves composting. While I haven’t succeeded with composting myself, ShareWaste is a great resource that allows me to give my compost to other people who have functioning composting systems! I’ve already connected with someone and will be dropping off my food scraps once my bag fills up. I also will be starting Plastic Free July, which will involve bringing my own Tupperware for leftovers and drink cups to cafes, avoiding the bakery or frozen section at grocery stores, and if I run out of an existing necessity, replacing it with a plastic-free option. I created a Notion page dedicated to Plastic Free July so I can track my progress and create systems that will ensure that I stay on track.

—STOP getting distracted at work! This has been a bit of a problem since I started this Substack, and I do have an issue with concentration—I have never been diagnosed with ADHD but I did need medical assistance when I was preparing for the GRE. With that being said, Substack is my major distraction at work, and I know that cutting it out will significantly impact my productivity output.

—CONTINUE going on walks after work. This might be more difficult as COVID has impacted our ability to exercise for long periods of time, even casual walks. However, whenever possible, I would like to maintain this habit since it generally is good for our health and well-being. Also, read!!!! I got back on the reading train this month and will be taking a short break from excessive film consumption (because if you’ve been following me on Letterboxd, I used to write a review every other day, sometimes every day after watching something). I find that reading is a much better, more intentional way to consume content than watching a movie is.

Thank you for tuning into this monthly list. I am so thankful to each and every one of you for taking the time to read my posts, as I pour my entire heart out into all of them. I’ve never once decided to publish something that isn’t my best work (excluding grammatical errors that I occasionally oversee), but I truly am so proud of what I’ve created on Bean’s Musings.

And of course, the hugest thank you if you have ever paid money for any of my Substack content. My paid posts are one of a kind, and I’m so grateful that you are willing to consider budgeting for my newsletter subscription. Thank. You.

PS: Thank you,

, for graciously gifting me the title font in this post!—Beans

Nice reflection! I recommend keeping compost scraps in the freezer till you can drop them off, if you're not already! Eliminates any smell issues, and you can keep it all in a plastic bag or container until you drop them off.

beans, you're truly such a good writer! i binge read all your articles last month, and after reading this i'm honestly impressed how invested i was in the sandals you purchased haha (an essential for sure!)

i caught covid (a second time!) in the first week of july, so the memory of the awful symptoms are still fresh in my mind - i'm glad you're all recovered now! take all the time you need for your break; i'll look forward to when you post again <3