money musings: jan 2025

all 4 items i purchased during my low-buy, my substack earnings, a strong resell month, and a perfume sample addiction

I’m back with a monthly list, or as I’ve rebranded them as a money musing, after going on hiatus from this series for two or so months. Did you miss it? Sorry if you didn’t. You’re getting one today. We’re sticking to the same format as last year, because why fix what’s already working? I was considering removing the Wheel of Life section, but I find that including it adds an element of my humanity, considering that I’m anonymous and I might as well add some personality to these newsletters.

As a reminder, these lists will be in three parts, as usual: 1) Wheel Of Life, 2) January 2025 Net Worth, Income, Expenses, and Investments, 3) Low-Buy Progress, and 4) Start, Stop, and Continue.

The Wheel Of Life is a self-assessment tool that breaks down different areas of your life and meausres the strength of each, on a scale of 1 (worst) to 10 (best).

Health (8) — My angular cheilitis flared up pretty badly, and ever since I ran out of my prescription ointment, I’ve only been using Aquaphor. It soothes a bit, but doesn’t exactly resolve the problem. I ate a lot of “messy” food that had high contact with the corner of my lips, exacerbating the flare ups. Outside of all of that though, my health has gratefully been keeping up with me, meaning, no painful bloating, sneaky viruses, or issues that require medication.

Emotional (2) — Early this month, the Eaton and Palisades fires ran rampant through Los Angeles, burning everything in its wake. While my parents’ homes were unaffected, their health, by no means, wasn’t. If you live in an area where fires are common, you likely know what happens during and after — scattered ashes on anything with a tangible surface, and terrible air quality. My parents have spent weeks cleaning the pool and debris that have taken residence all around their home. Even my elderly dog, aged 16 years, was noticeably slower and weaker when the fires were at their peak. Los Angeles won’t ever be the same for a long time, and it breaks my heart thinking about the thousands of people whose homes and health have been directly affected. Trump’s policies in regards to removing DEI policies, gender pronouns outside of he/him and she/her, CDC’s national datasets, meetings involving grant reviews at the NIH, and so many more have brought me immense frustration, near to tears. I’m grateful for people like Matt Bernstein, who uplift their community through educational content and powerful messaging — we are all in this collective struggle together.

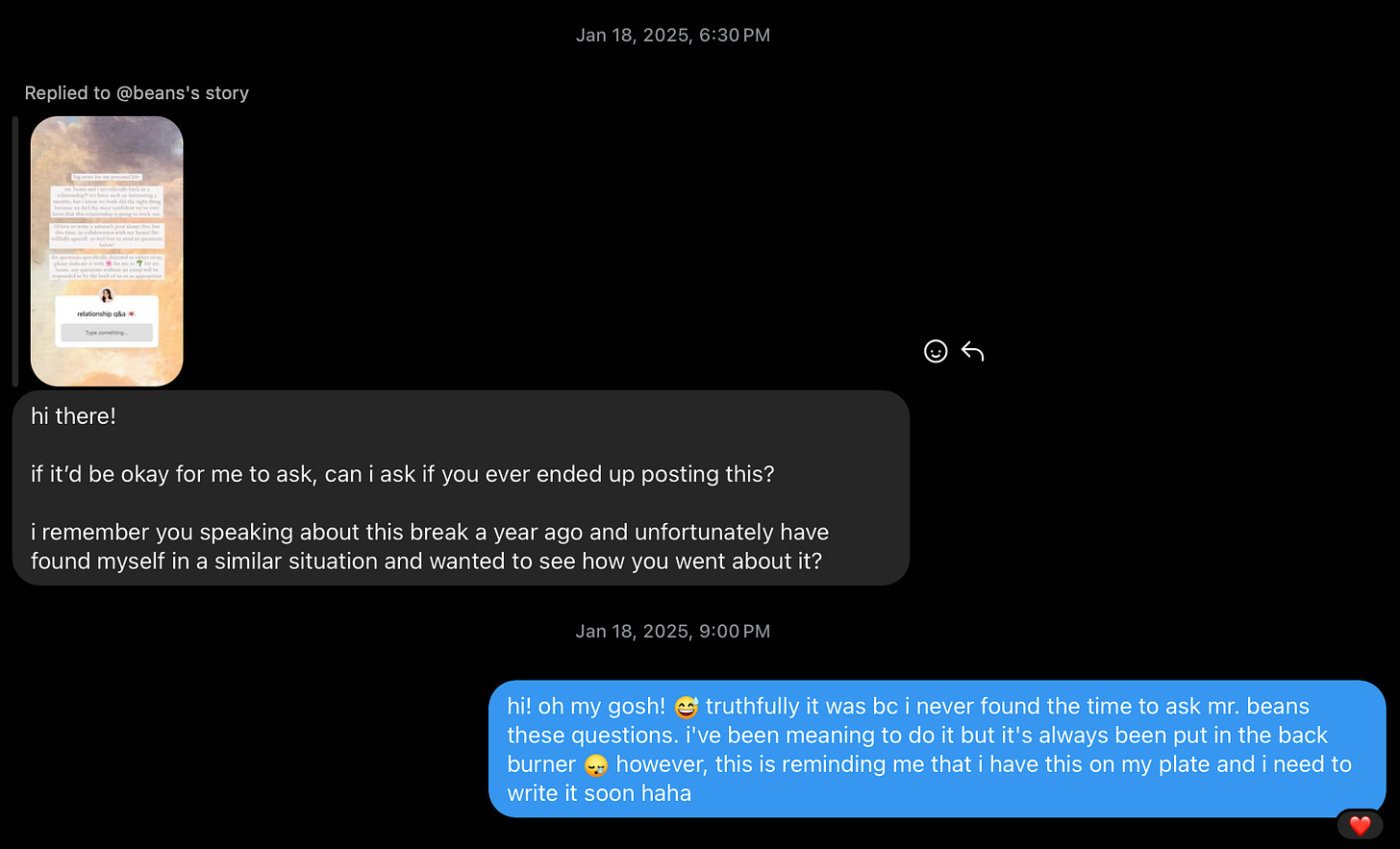

Relationship (10) — Been really grateful to have Mr. Beans by my side. Not that I’m usually not grateful because I always am; this month, it’s been pure bliss for us. We just had a wonderful month together with disagreements that didn’t turn into arguments, silly and fun banter that had us constantly laughing for hours and hours on end, and he even found the time to see my parents this month, which is always so special. I also was very surprised to receive this message (below), following up on my newsletter that I was supposed to publish regarding our break last year. I am still going to post it, even though it’s been about a year since it’s happened. Mr. Beans and I have learned so much from it together, and I’ve been trying to find the time to 1) remember to ask him questions, and 2) find time for him to respond. I personally think our reflections one year later will provide so much more insight than if I published it some time last year! (Yes, this is me coping for delaying this post.)

Friendship (7) — I spent a lot of time with Egg this month, and I can only thank Mr. Beans for encouraging me to speak my truth. We hung out around three times this month (insane), and every single time, it’s been a lot of fun. I didn’t see Bumble Beans mainly because we spent half of December together in Taipei, and upon landing in LA, she was busy moving into a new apartment.

Professional (3) — Trying to keep my head up here. Been applying to jobs as much as I could muster up the motivation to (it’s hard). I talk about the job hunt more in-depth here.

Finances (7) — After reviewing YNAB, I am pleasantly surprised at how my numbers fared. Though my pace to hitting $200k in net worth is slower than I’d like, I’m now more focused on what my categories look like in YNAB rather than being obsessed with my net worth, which by the way, is a financial indicator that I do not have direct control over.

All in all, my average for the month was a 6.2. Could be better, but I’m not complaining as I was averaging 5’s and lower last year.

A detailed overview of my income sources, mandatory expenses, non-essential expenses, and savings/investments. I use YNAB, a budgeting tool that allows me to budget with the money I already have, instead of what I plan to make. This section does not contain any financial advice; please do research on your own prior to making any investment-related decisions.

NET WORTH increased to +$178,345.44. $200K, here I come!

INCOME amounted to +$6,150.36.

84% Full Time Job | 16% Side Hustles

Full-Time Job +$5,188.31: Three paycheck month — woo!

Substack +$164.27: I can’t believe I hit $100 on my monthly Substack earnings. This a wild achievement — thank you. Last year, my total Substack earnings was $446, and I’ve already hit almost 50% of that in January. What?! I love all of you lovely people who have spent any money to support my writing. If you aren’t able to afford my subscription cost, you can always opt for the referral program for a free paid subscription! More information can be found here.

Claims +$137.54: A bunch of claims I filed for last year came through this year. Free money for barely any work!

Ebay +$191.44: Sold a Sézane cardigan, protein powder, and packing cubes.

Extra Cash +$69.00: Deposited extra cash laying around in my bag. Not sure where it came from.

Facebook Marketplace +$266.00: Sold a bunch of small little things. All added up. I’ve learned Dec/Jan are great months for resellers.

Interest Payment +$108.40: With Wealthfront, of course.

Rakuten +$25.40: Some cashback that I kept forgetting to transfer from PayPal to my account.

PERISHABLE EXPENSES amounted to -$1,582.12 (26% of income).

Perishable expenses significantly impact my ability to comfortably live my life. So yes, I will “perish” (and yes, I get that this is an overstatement but I am a dramatic woman) without budgeting for these expenses. These are ordered from first to last by importance.

Rent -$1,370.72: Sharing a two bed two bath with Mr. Beans.

Health +$40.00: I purchased a pair of Warby Parker glasses and submitted my receipt to my insurance, where they reimbursed me $40 out of the $215 total. Ultimately, I returned the glasses because they fit me so poorly. This $40 will go towards another pair of glasses this year, as it is one of my goals to get a new pair of glasses. The one I own is around seven years old (wild).

Groceries -$210.87: Low spend category since I saw my parents in the first week of January (free food) and visited them twice on weekends (free meals for the first few days).

Gas -$40.53: On this post people were livid at this amount. It’s true! I am able to survive off of less than $50/month on gas because I work a hybrid schedule, my office is a 15 minute local drive, I live very close to supermarkets and malls, and I stack my errands in a day instead of doing one-off trips. I also drive at the speed limit and avoid speeding up when I see a red light. Here’s a great Reddit post on how to save fuel while driving.

PRIVILEGED EXPENSES amounted to -$337.30 (5% of income).

These are items that, with my privilege, I am gratefully able to afford them. They impact my life positively, but not to the point where I would “perish” if I didn’t have them. These are ordered from first to last by importance.

Spotify -$16.99: Monthly charge for a family plan. Everyone Venmo’ed me their year’s subscription share last April ($2.83 per month * 12 months = $33.96 per person), so now each charge deducts from that balance. Rinse and repeat this April.

Maintenance -$187.79: Overspent a bit here, mainly due to some expensive Target runs. Stocked up on the bare necessities: dish soap, laundry detergent, scrub daddies, and more. Also purchased some copper tongue scrapers.

Dates -$64.13: Three coffee study dates and one dinner.

Social -$68.39: Brunch with friend, her boyfriend, and Mr. Beans.

RICH LIFE amounted to -$929.34 (15% of income).

Rich life expenses are nice to have, but by no means necessary.

YNAB -$109.00: Not on the free student plan anymore (sad!) so I upgraded to the yearly plan.

Home -$255.88: Sent my sinking fund balance to Mr. Beans since he recently purchased a new Thuma headboard and throw pillows for us.

Low Buy -$627.92: See next section for everything I purchased.

Gifts -$63.46: Meals for Mr. Beans because of his birthday, pottery session, hot pot, and coffee for parents.

INVESTMENTS amounted to +$2,912.81.

I only display my net, not gross income, so the “Employer Retirement Account” amounts do not make up any part of the Income amount.

Roth IRA +$583.33: Starting the year strong by contributing to my Roth IRA. This amount will allow me to max it out perfectly by the end of the year.

Employer Retirement Account

401A (My Contribution) +$1,620.43: With my salary, it is quite difficult to max out this account, so I’m doing the best I can.

401A (Employer Contribution) +$709.05: Always grateful for that 8% match.

Savings +$3,321.19: This amount is my income subtracted by the expenses listed above. YNAB is handy, because I don’t always have to send the full amount to only my sinking funds. I am able to “pre-fund” spending for the next month’s expenses ahead. Therefore, this amount covered a portion of my perishable expenses for February. If you’re interested in learning more, this guide walks through what I did.

As a quick recap, if you missed my newsletter on my 2025 low buy rules in excruciating detail here, with my clothing-specific rules in this one — I have set a goal to purchase no more than 24 non-essential items this year, with a maximum of 5 clothing pieces (embarking on

’s Rule of 5). If you have any confusion on how I’ve conceptualized “non-essential”, this post will answer your questions and beyond (seriously, it’s a long one). Here’s a high-level summary if you can’t be bothered reading the newsletter version:My goal moving forward with these monthly musings is to avoid, as much as possible, mentioning or linking exact brands or items to avoid any accidental influencing. I am not “gatekeeping”, but I also don’t need you thinking you need an item when you actually don’t. With that being said, if you are truly interested in an item, please DM me on Instagram about it. If you are consistently invested in the specific items I’ve purchased, then my Report Cards have every single item that I’ve purchased hyperlinked. Those posts also have every expense I’ve made in a month organized by green, yellow, and red light. Items you’ll see in these Money Musings will contain yellow/red light items.

Item 1: Sweater Cardigan ($68.23)

Yes, this was a red light purchase, but do I regret it? Absolutely not. It’s red light because I wanted to purchase my clothing pieces secondhand, or at least try to. I have to rethink my clothing rules because I’ve personally struggled buying secondhand as I don’t enjoy buying items in-store, and especially if it is an item I’m unsure about sizing and fit, I would rather have the flexibility to return it if possible. This mentality goes for all the other items I’ll be listing here, and it is something I’d like to work on and shift this year.

Bree from ritual_finance messaged me, recommending this sweater since I was looking for a “blazer/cardigan” type garment. After seeing it on the model, I knew it would be a hit in my personal wardrobe. Upon receiving it, I’ve had to tell myself to not wear it every day, because that’s how obsessed I have been with it. Think of the Sézane Betty Cardigan (which I ended up selling), but more comfortable, more soft, and less high maintenance.

Item 2: Trousers ($137.92)

I do not own a single pair of “corporate” friendly trousers. I’m talking, ones that drape beautifully and are made with a silky, flowy fabric. That’s why I embarked on my “Perfect Trouser” adventure this month (kind of fun, kind of exhausting). Ultimately, I did end up with the best pair, though it needs some hemming at the bottom. Thankfully, my mom can do this so I don’t have to see a tailor and spend extra money on this modification. I can’t wait to buy these in more colors (secondhand) now that I know my size.

Item 3: Blazer ($162.92)

The only blazer that exists in my wardrobe (before adding this one to my closet) is one my mom had in her wardrobe and one I’ve never seen her wear. I have no idea where she got it from, but everytime I wore it, I wanted to cry in tightness. Even though I’ve accepted that blazers should be tight in the shoulders, it shouldn’t feel like chains of unrelenting suffocation. This new blazer I purchased still has structure and stiffness in the shoulder area, but everywhere else, there’s give in the fabric. It’s dry-clean only, which goes against my clothing rules for low maintenance cleaning garments only. Is there even a blazer that is actually machine washable? I’d love to know (for research purposes).

Item 4: Jumper ($113.39)

Wearing this jumper as I type at this moment. I was hesitant about making this purchase because their return policy is nonexistent — store credit only?! In this economy? This jumper seemed foolproof enough to purchase (like you really have to be a terrible brand to botch this), and upon receiving the garment, I’ve been happy. It’s pretty oversized, so I know I can layer comfortably underneath. There is bagginess underneath the arm area, which I love because it gives me more freedom to wave my arms around without restriction. It’s a classic silhouette that you can’t really go wrong with.

Total Count: 4/24

Low Buy Reflection: Month 1

I could’ve done better. Well. Okay. I didn’t have to go absolutely nuts and purchase 4 items in the first month of 2025, but I don’t regret any of them. That’s likely the excited version of myself who now has new pieces to play around with speaking, but seriously — these pieces are high quality, investment worthy pieces. They’re ones that I know will last me a very long time, and are versatile with other pieces in my wardrobe. The blazer and trousers were an imperative purchase for my upcoming conference (where I will be presenting!), so even though it is categorized as red light, it is a necessity in some way.

The behind the scenes of this low buy included three returns. I’m proud of this number, because last year, I had around 8 or 9 returns at this point in time. The reason being, this year I mainly purchased from companies that allowed me to try the garment on in-store (except for one). That way, I could decide for myself if I really liked it or not in the fitting room, without having to go through the hassle of repackaging the item for return. I’m also extremely proud of myself for returning an item that cost me $350. I did not have the funds for it, and it was very much a fantasy self/impulse purchase.

This section contains things I’d like to start incorporating into my routine, things I need to stop doing because they are detrimental to my health or wellness in some sort of way, and things I’d like to keep up with throughout the next month.

START paying attention to my grocery shopping habits. If anything, groceries is the one place I’ve struggled with — mainly with produce going bad. I posted here, as part of my no buy rules for the next few months (until I get a job), that I wanted to buy more packaged food and less fresh produce. What I mean to say is to purchase pre-cut vegetables or frozen vegetables (absolutely terrible for the environment, but does wonders for my stress levels and ability to keep things fresh in my fridge for longer). I am so sick of throwing out moldy veg. I can’t even explain how many times I’ve had to do this last year, and it’s quite embarassing considering I wanted to embrace elements of sustainability then. Not that I’ve given up on that, but I acknowledge that I will subsist off of the unhealthiest meals if I don’t take advantage of what Trader Joe’s has to offer.

STOP buying yellow and red light coded items. As mentioned in my no buy post on Instagram, I am not sure if I’ll seamlessly land a job right after my current one ends. Therefore, saving as much money as possible is imperative at this moment. I’m trying to avoid dipping into my emergency fund, or at least delaying it as much as possible.

CONTINUE investing ways to get free things, ethically. I became really intrigued by finding my signature scent late last year, and am still on this journey. After getting a few free perfume samples from Byredo earlier this year, I’ve made it a habit to get at least one or two free samples every time I go to the mall. It’s a lot of fun, and satisfies any itch to shop — all without spending a single dime. Do note that I actually do take the time to converse with the salesperson on their fragrances and stay with them for 15-20 minutes, at the very least. Don’t be the type of customer to waltz in expecting free fragrances off the bat.

I totally agree with you about evaluating our grocery shopping habits - it’s a goal of mine this month! I’ve been eating healthier but that means I go to the store 2-3 times/week. I’m trying not to waste food but not having a meal plan is killing me.

Loved this! Especially your goal with produce, I throw away so much too that I now only buy frozen broccoli!