budget breakdown, episode two

yerim's january 2025 spending, breakdown of her $6,120 wedding, and living in singapore

Welcome to the second episode of Budget Breakdown, where I feature finance creators’ budget for a designated month — this includes their real numbers for income, expenses, and savings/investments. In addition, they answer my questions about their 9-5, academic and career trajectory, side hustles, and/or monetization surrounding their social media presence. Most importantly, I end each breakdown with lifestyle-related questions to shine light on their qualities outside of just finance.

I am so delighted to feature Budget By Yerim as my second guest on this series — please give her a warm welcome.

What is your name/username?

Yerim, @budgetbyyerim

How old are you, what is your job title and field, what type of city do you live in (high/medium/low cost of living, etc.)?

28 this year. Currently in a HR role in the Built Environment industry. Living in Singapore which is a HCOL city.

Where (if not, what type of institution) did you attend? What degrees do you have?

I did a double degree in Tourism & Hospitality Management/Human Resources Management so I have a Plan B in case the other doesn’t work out

Is your degree related to the career you're pursuing at this moment?

Yes, my HR degree is coming to good use at the moment!

What do you use to manage your finances? A budgeting app? Excel sheet?

Cashew - daily expenses

Google Sheets - dividend breakdown and calculation of NW increases/savings rate

What are your short-term finance goals (e.g., save for your kid's college education, buy a house, an upcoming vacation, your wedding)?

Saving for a downpayment for a house and a wedding (I am still on the fence about this but it will highly likely occur anyway for my parents as 1) I am the only daughter and 2) in Asian culture, we are typically able to recoup wedding expenses through the red packets provided by guests) - I do wish to point out that this will not change the fact that I am planning the wedding on a shoestring budget and only going with the minimum because I want it to be a cozy affair with selected family members and loved ones. Coming from a place where I want to hold a celebration because I CAN afford it and red packets are simply a bonus.

Do you recommend any finance books/creators/podcasts that have been integral to your financial independence journey?

I am a huge fan of Ramit Sethi - have watched his Netflix show, read his first book and watched multiple podcasts. My favourite videos are the ones where he rates financial advice from Tiktok. I find that a lot of his money mindsets are relevant to me in this stage of my life.

All dollar amounts in this section have been converted from SGD to USD.

Net Worth:

Slightly over $150K as of writing.

Cash (Emergency Funds, Sinking Funds and Daily Expenses)

Investments (Central Provident Fund - Singapore equivalent of a 401(k), Supplementary Retirement Scheme or SRS - Singapore equivalent of a Roth IRA, Brokerage and Robo-advisers)

Investment-Linked Policies (which I highly regret due to the % management fee but I am too deep into it to surrender my policies)

Income:

Salary $3,097

Carousell (app for reselling items) $710

Red Packets (from celebrating Chinese New Year) $555

Focus Group $74

Interest $22

Total $4,458

Essential Spending:

Bill payments $1358 ($959 to debt)

Sinking Funds $812 (As of 2025, I consider SF as pre-spent expenses)

Food + Groceries $770 ($550 was Mr. Y’s birthday dinner)

Transport $81

Self-care $52

Total: $3,073

Non-Essential Spending:

Clothing $163.51 (Mostly seasonal wear for travelling as my current wardrobe is not appropriate for below 10°C weather)

Couple $1,350 (Went to a fortune teller and got a necklace)

Travel $65.34 (Theme park tickets and eSIMs for myself and Mr Y)

Entertainment $144.29 (Tickets to standup comedy and $100 for a arcade card reload)

Gifts $79.33 (Mini gold bars for my parents - I split the cost with Mr Y)

Miscellaneous $16.22

Total: $1,818.69

Sinking Funds:

Insurance SF $221

Couple SF $221

Travel SF $369

Congrats on getting married earlier this year! How much did you spend in total? Where did you splurge and where did you save on? Did you have any money wins/regrets?

Thank you! We’ve spent about $6,120+ in total so far. Huge splurges were on the pre-wedding photoshoot which cost $2,212 and on our rings $2,818.

Numbers reported in Instagram posts by budgetbyyerim are denoted in SGD, not USD.

Wins

Hair and makeup: I went to the same place I took my passport photo at as they offer hair and makeup service for $89 — wedding MUA would have cost 2 - 3x the price

Clothes: I spent $190 on my dress and Mr Y’s top and bottoms, we went with a cozy resort vibe instead of a conventional wedding and suit. It was a win because we would eventually wear the same clothes as one of the concepts for our pre-wedding shoot and will rewear them in the future.

Regrets

Having the pre-wedding photoshoot in Taiwan: While it was a great experience overall, I would want to do my shoot in China or Bali instead as they tend to provide more digital copies and fewer hidden costs. Because we were already there, it was hard to avoid paying these costs when they arose which resulted in a higher than expected spend on the entire PWS.

Not opting for cheaper rings. I splurged on a Cartier wedding band for Mr Y and he got me a diamond proposal ring + a pave diamond wedding band. We rarely wear our rings and it would have been a wiser choice to opt for cheaper bands and do away with the proposal ring — this would have set us back slightly below $1,475.

You reported doing some side hustles earlier this year — could you talk about how you got started with them? The amount of effort/time and whether it pays off well?

Carousell

I actually started off reselling items more than 10 years ago but only really started tracking my earnings and making a concentrated effort to declutter my items when I started this account.

Effort 5 out of 5 (It is time consuming to take photos and having to post with descriptions. Not to mention entertain accounts that ask multiple questions and end up ghosting)

Payoff: 4 out of 5 (Depends on what you are selling. If you are simply decluttering then profits may not be as high, if you are reselling new items it is up to you to adjust your selling price to ensure it stays competitive yet gets you a decent profit margin)

Surveys

Started 3 years ago and have been consistently getting at least $369 a year from this income stream

Effort 3/5 (It is disheartening to get screened out after you spent a considerable amount of time on a survey, but since I do this on the go or on the clock during lull periods, whatever I earn on top of my salary is a bonus since the quick polls can be completed quickly. However, hard to scale up compared to others since there’s only so many surveys one can do in a given period and controlled by the number the website decides to release)

Payoff 2/5 (Probably one of my lower earning side hustles but payout has been consistent and comes in the form of supermarket vouchers as well. So realistically my average amount from this would be somewhere close to $737 a year!)

Trading

Also started taking trading more seriously after

I created my finsta account

Effort 4/5 (Rated it higher as much time is initially spent on getting your foundation and mindset solid — understanding your risk appetite, technical analysis, practicing with paper accounts and knowing when to walk, etc. Information from other finsta accs and youtube has since made it easy to learn)

Payout 5/5 (Easy to scale your capital for more gains, quite easy to make it a steady yet high income stream if you practice discipline and take earnings when you can)

What is it like working in corporate?

Contrary to popular opinion, I actually like being a corporate slave. I keep my work strictly within the confines of 9-5 and rarely bring work home which allows me to minimize burnout. Aspects like opportunities for development and company benefits are perks which are otherwise unavailable to an entrepreneur. My close friend who is an entrepreneur, works 12 hour days with probably only 1-2 days off in a given peak period — that’s not something I want for myself even if it means that I earn twice the amount I do now.

How do you split your finances with your partner?

Our finances are still kept separate, though we are considering to merge our accounts and have both pay cheques flow to one account. For now, we both contribute to a couple fund every month and we take turns treating each other when we go out. Overall, I pay more and volunteer to pick up the more expensive bills since I earn more than my partner.

Pros/cons of living in Singapore + would you ever move elsewhere (if yes where)?

Pros

Transportation network of buses and trains is pretty extensive here, making it easy to go pretty much everywhere

Safe: Females can go out alone at night, children can get home from school by themselves

We are probably the only country with a balloting system for married couples and singles above 35 to own a flat with grants from the government and monthly repayments from our CPF (401k). It can go as low as $300k and if our CPF contributions can cover the monthly flat repayment, we will not need to fork out cash for the flat

Cons

A HCOL city

If I had a chance to move elsewhere, I would consider moving to another country within SEA with a lower cost of living (Malaysia/Indonesia/Thailand)

3 things you cannot live without:

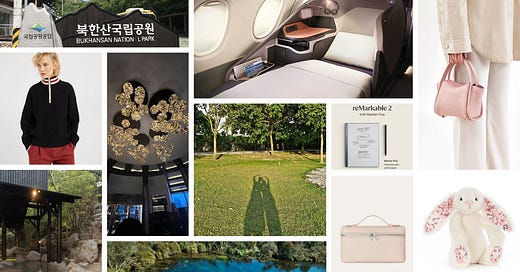

My jellycat bunny that Mr. Y bought for me with his first paycheck after relocating to Singapore

Kindle

Phone

I'm currently listening to:

Case 288: Mark Van Dongen (True Crime Podcast on Casefile)

I'm currently reading (and the last book I rated 5 stars):

Surrounded by Idiots by Thomas Erikson

I don’t think I’ve rated any book 5 stars yet but titles that come close are The Seven Year Slip by Ashley Poston and Check & Mate by Ali Hazelwood.

Things you love:

Japanese Food

Travelling

Jellycats

Things you've regretted spending money on:

Clothes that didn’t fit well or are not a good color based on my color analysis palette

Your last day of earth meal spread:

Truffle wagyu potato chips by a local restaurant

McDonalds spicy nuggets (they’re a thing in Singapore)

Ichiran ramen

Shucked oysters

Grilled garlic butter scallops

Spicy salmon sushi from Genki Sushi

Items on your wishlist:

Mini Song Bag from songmont

Disney cruise

This was really fun to follow! I feel you on the side hustles… there is definitely a lot of “hustle” involved. I made $10k last year but when looking back I almost wish I spent that time working out or hanging out with friends. I explore some of it here in my latest post, check it out if you’re interested! https://open.substack.com/pub/nontraddad/p/why-im-not-checking-my-bank-account?r=532ujb&utm_medium=ios