2024 started off relatively impulsively on the non-essential front. This is new for me, because prior spending patterns have revealed that my spending slows down in the winter-time, ramps up during May/June, slows down again in mid/late-summer, and ramps up again around the Black Friday/holiday season. This year decided to be different. After feeling quite heavy about my recent purchases these past couple of months, I wanted to make a guide that will help not only you, but me with shopping more intentionally than impulsively.

This post is broken down into 4 parts: 1) the origin, 2) the purpose, 3) the strategy, and 4) the resources.

the origin

The importance of why reflecting on your origin (your childhood and any related trauma) is important when trying to understand your spending habits. This step is best done with the help of a therapist, but I have also included ways you can complete this step without one.

One of my recent therapy sessions was about my spending habits. I felt overwhelmed by all the items I purchased in the past three months, the regrets I made (which may or may not end up getting resold to another customer), and the items I added into my life that I could have waited out on. On top of that, the warning signs that kept going off, telling me that I could only purchase 36 items and I currently am at 13 items, increasingly sent me into a state of emotional paralysis where all I could do was sit numbly and think about why, why, why.

Now, I’m telling you all of this because I don’t want you to feel like it’s not not normal to grieve the loss of your money, especially if the items you spent money on weren’t particulary necessary. As someone who doesn’t have any debt at all and am in a relatively comfortable financial state, I want it to be known that I still do feel this debilitating and numbing overwhelm that occasionally gives me panic attacks. But with that being said, one thing my therapist had me do was to re-evaluate the way I perceive myself — she noticed that I had a confidence-related trigger related to spending and budgeting. While I want to save and achieve financial goals, it also is difficult to not have certain things, especially if it’s all my brain could focus on. I learned that my impulsive spending is a symptom of my self-loathing and criticizing tendencies, where I tell myself and everyone else that I am a minimalist and I strive to own X (a relatively small) number of items. Ultimately, I have an obsession with the idea of living a minimalist life and being perceived as a minimalist.

The idea of wanting to have this minimalist identity started from my childhood, as it usually does with every present problem, obsession, and thought. Growing up, whenever I would ask my parents for a new Abercrombie shirt or the Juicy Couture velour track hoodie, they would instantly say no because they were too expensive. Understandably so, as these items were purely trendy and quite tacky — how was middle/high school Beans supposed to understand the concept of timeless fashion? My parents would buy me clothes, but very sparingly and from outlets during holiday season where the already discounted items would be more steeply discounted. There came a point where I chose items just because I knew I wouldn’t be able to get them at full price, and if I pulled up to class with a shirt that said “Hollister & Co.” across the front, I’d fit in with the rest of my classmates.

I never received an allowance from my parents, and while this isn’t me trying to complain about that since none of my other fellow Asian friends received allowance either (it’s a cultural thing, I guess), I wish I learned how to save at an earlier age and make mistakes by spending all my hard earned allowance on ice cream when I should have saved up for movie theater tickets. I don’t think my parents ever trusted me with money, so once I received my first paycheck at the age of 19, I spent it all on clothing. I probably saved around a total of $100 after 6 months of working.

Reflecting back on how finances were discussed in my childhood helps me understand in greater depth why I spend the way that I do now. It highlights places that I need to pay more attention to, which includes addressing my lack of confidence with saving, identifying all the triggers that cause me to spiral into regret regarding these purchases, and developing strategies that will help me cope with regret if I do find myself spiraling.

I wasn’t able to figure all of this out until my last therapy session, and if you have the means to talk through something like this with a professional, I highly recommend it. However, if it isn’t within your financial capabilities, I would recommend asking yourself the following questions:

What is your relationship like with money? Do you feel like you have an adequate amount of control of your finances? Or do you feel like your finances control you?

How did you learn to manage your finances when you were younger?

What were the narratives and advice that you were told at a young age regarding finances?

Do you know how to differentiate want from need?

the purpose

Not to be overly repetitive with what everyone has probably told you to do, but understanding your purpose, or why, to stop impulsively purchasing is a critical step. Everything must have a guiding purpose, otherwise efforts will run amok until you find yourself asking: “How did I even get here? How did I end up spending X amount of money on clothes? How did I accumulate this much clutter? How did I end up in consumer debt?” Everyone’s purpose is different, so don’t outsource your responses based on other people’s motivations.

For me, my purpose is to live a more simple life, filled with less chaos, clutter, and external noise. There is less chaos if I spend in a way that doesn’t leave me filled with regret. There is less clutter if I simply own less material goods. There is less noise if I can hear my thoughts peacefully and coherently, without the interruption of notifications or never ending to-do lists.

There is more to just cutting out impulsive spending to be able to achieve the purpose I listed above, but I know that impulsive spending contributes to at least 50% of the problem. I love seeing my bank accounts grow exponentially. I love watching my net worth increase after hitting one milestone after another. I love staying within budget and not seeing a red alert as a result of over-spending in a certain category. It fills me with so much joy to be financially independent and prosperous, and all of these intentions tie into my purpose of wanting to cut out impulsive spending.

the strategy

This section contains various strategies to curb impulsive shopping, all of your responses regarding advice on impulsive spending, riseandshinemoney’s Instagram posts, systems for each situation where I tend to find myself impulsive shopping, and whether an intentional (or no/low) buy is right for you.

Once you’ve reflected upon your origin and outlined your purpose, it’s time to strategize. What systems can we put into place to ensure that we minimize, and ultimately cut out impulsive spending for good? Let’s be clear – even someone like myself who values intentional spending and intentional living makes mistakes. I’ve been completely transparent with where my mind is at and how I’ve wasted so much money on clothes this year, but that’s also because I never had a strategy put into place. This post is not only to help you, but to help me get my shit together and enact a foolproof system in place so that I don’t waste that much money ever again (or at least for the rest of this year).

I’ve rounded up a summary of responses received from the Beans community after I posted this story. If you missed it, turn on notifications so you can contribute to the next guide!

your responses ⋆˙⟡

I started using a wishlist/wants tracker on Notion! Keeping track of my “current wants” and the dates I added these items to the tracker helped me slow my shopping down a lot. I also share this with my partner and family members whenever it’s the holidays/my birthday so there’s no guesswork on what I want.

Some people go by the 48 hour rule - if you’re still thinking about an item 48 hours later, buy it—that’s too short of a time frame for me, so I extended it to a month. This helps with not buying into “microtrends” as well since what’s “in” changes so quickly.

I do this most often when grocery shopping — I limit myself to one item that isn’t on my list so I have freedom to treat myself if I see a good sale or something I like. Other than that, if it’s not on the list it’s not in my cart!

When impulsive online shopping I try to go to my closet to see if I have something that already serves the purpose of what I want to get!

Especially for clothes, I have to ask myself, “Do I want this because it looks good on me or because the person who wore it looked good?” Like when I’m on TikTok and I like their outfit, I have to consider whether I really think this fits me or I just want it because it’s trendy. I bought Gymshark leggings and sports bras—the bras are smaller than I expected and the leggings are longer because it’s for taller people 😭 all because I got tempted with GymTok.

Something that might be worth examining is whether your regret is tied to the items themselves or if perhaps it’s connected to your change in life circumstances and the regret stems from now having an item that doesn’t align with your current living/relationship situation.

I think I mentioned this before but not ure if you remember but (something similar to your Notion template) taking a photo of the item I want (or if I find I ‘want’ and coming back to it a couple weeks later, if I have the money for the wants because even though I am unpaid as a stay-at-home-mom, also agreeing to not working, I don’t want to spend my partner’s money willy nilly/just because I can.

What I have been practicing for the past months is if I see something I like or feel like I need, first I write them down in a list and categorize them by need, nice to have, or something I could ask as a gift for Christmas/birthday. I just let myself sleep on it and if in the next day(s) I still feel like I need to buy it because it would make a huge impact in my life quality, I get it. Some things have been in the list for months and I have been able to live without them, so that's just a technique I have found helps me control my impulsive buying. Oh and also for clothing, I first try to see if I can find something similar secondhand, but it's not possible all the time of course.

I’m currently doing a low/close to no buy because I’m trying to get over impulsive shopping. Whenever my mental health gets low or I’m unhappy I’ve realized I tend to do it more often. I tell myself I have a lot at home and have pretty much everything I need there and I create lists every month of a can buy, and then a wants list for future purchases. I redo the lists monthly. Before I redo them I see what I can remember from the wants list and if I can’t remember it I remove it. I only buy off that list if it’s been on there for 4-6+ months and if I can afford the item without any impact to savings and it doesn’t go over my budget for the month. I taught myself to make my favorite foods and coffee at home and only get those things out if I’m with friends. Also with clothes I tend to thrift unless I really need something and I get it on sale.

If I’m willing to pay full price and willing to pay for it twice, then wait 3 weeks and if I still want it, then wait for a deal. Deals can either be percentage off on the website and or high Rakuten percentage back. I understand not all items goes on sale such as luxury goods but almost everything has at least 10% off with email sign up. For example I have a soft spot for Lego. Not all Lego goes on sale but Rakuten does have 10% back sometimes. I love Tiffany jewelry but their items only increase and never decrease and there are no sales. I’ve waited 5-6 years for the rings I wanted but prices just kept on increasing. I was kicking myself when I finally made the purchase but now I’m happy because prices are now over $3K when I purchased mine for around $1,800 and $2,000. Those RTT chunky bracelets I got for less than $200 each now go for $500 plus.

I’ve been tracking my unplanned purchases monthly to give me a live feed instead of waiting until the year ends as I want to aim for a low buy year. I’ve got a vision board of things I can buy and I’ve taken inventory or what I have already to avoid duplicating.

I am definitely trying to buy less clothes this year unless I really need to replace worn items or don’t already something similar to it 😭 I found that I would impulse buy when checking emails from brands I’m subscribed to & seeing the latest arrivals and sales. I’ve unsubscribed from most of them and actively avoid checking out their websites 😂 I’m also avoiding going to stores to “window shop”, as I tend to buy things I find cute at the moment but don’t really need. I’m trying to only go to stores with a plan in place & items I’m truly looking for.

I use MoonSift to add things to my wishlist and I only let myself buy things that are on sale (either using MoonSift or Keepa if it's an Amazon product to track sales). I make sure to buy the product at its cheapest price, and that gives me plenty of time to figure out if I truly want the item or if it was going to be an impulse purchase. But if it was something I reeeally wanted and had been thinking a lot about, it's SO EXCITING to get that sale notification. It's like Christmas morning and considering I have ADHD, this has helped curb my impulsiveness when shopping and gives me HUGE dopamine hits. There was one time I wanted something really bad (Bose headphones) and I set up an IFTTT to my Alexa to announce when the sale happened. Hearing that announcement was so much fun.

1) Sit on a it for a few days to see if it’s an emotional buy versus need. 2) Take a look at the stock you have and gauge whether how necessary. 3) Look for best deals — there should be a platform that has infomation on best price / promos going on. 4) If it’s clothes or shoes, I tend to throw away or donate one piece when purchasing a new one, keeping a concise wardrobe. 5) Make spring cleaning a quarterly routine at least. You will realise how much junk you have.

One of my favorites things to do when I go to Target or other similar places is buy a $2-3 Icee or smoothie and keep my phone in the other hand. I’m less likely to touch things/it’s a hassle usually to put them away. Then I’m less likely to buy them 😂 I also give myself 72 hours. If I still want it 72 hours, then I’ll add it to next month’s budget

Unless something is a super good deal that will expire soon, I’ll basically wait at least a week from when I first feel the urge to buy something. That way, I know if I really want it even after the initial ‘OOH SHINY’ phase has passed. Another thing I’ve realized I do somewhat unintentionally is for anything over around $10, I have a general mental list of things I need in the sense that I have a genuine space I want to use something (ex: workout clothes if I’ve noticed I’m doing laundry more often just to have enough clean ones). Anything outside of that list I won’t buy. This doesn’t account for super hot deals and things you can only buy in person while traveling (things you can’t come back for in a week)—still figuring out how to deal with those.

Took Amazon and Target apps off my phone. Have to use my laptop if I need something.

1.) Window shop, but before entering the store, promise self not to buy anything. I feel really good when I keep that promise and that’s an incentive in itself. When I’m with someone, I tell them “Let’s go in, but I’m not buying anything ok!” Maybe it’s just me but making this “announcement” sort of keeps me aware of my goal of not buying throughout my time in the store. 2.) When I find something I’d love to have, but couldn’t buy for reasons like it not being essential, I write the item and its price in a list of things I wanted but didn’t get. This list records just how much I “saved” from not buying and it makes me happy when I look at it because damn I’m saving a lot! 3.) For non-essential things that I really really want, I schedule when to buy it, for example, after the next payday. It would be when it’s most comfortable for me financially. If I deny myself too much, it gradually makes me feel miserable, and with that build-up, I end up impulsively buying something as a stress reliever.

I went back through my credit card statements from the last couple months and divided the transaction items into loose categories of “wants” and “needs.” Needs being things like groceries, replacement toiletries, some clothing, and take away breakfast before work. Wants being things that I enjoy, but don’t necessarily need right away, like getting my nails/hair done, or buying new books (when I already have 10 unread on my shelf). To help ease into it, I have been allowing myself three “wants” per month and tracking/labeling them (with the rest of my spending) on an Excel spreadsheet. I really like this method because it gives me an opportunity to reflect on my spending without judgment. It also allows me to easily identify where I am spending money and determine for myself what I deem to be a want or a need. This has involved a LOT of self honesty, but it is teaching me to be more cognizant about what I spend my money on in the future.

things that have helped me ⋆˙⟡

Leave “Buy/Sell/Trade [brand]” Facebook groups. It’s not helpful seeing clothes on my Facebook feed everytime I open the app.

Find items to sell around the home, and actually take the time to list it on Ebay or Marketplace. The dopamine hit when someone actually makes the purchase far exceeds how I feel when I buy something using my own money. I prefer selling clothing items on Ebay (items that have “more value” but are also easy to ship), while I sell larger furniture pieces that I prefer to meet up in person to sell vs. ship off to on Facebook Marketplace.

Take a goooood look at my budget. I’ve made a few posts on how I budget and allocate my money. See here, here, and here if you’re interested. Long story short— once I’ve set aside how much money I’d like in my cushion and my newly created “low buy” categories, I do need to look at both of these prior to purchasing anything, just to see if I have money left over.

riseandshinemoney’s posts ⋆˙⟡

One of my finance pals, riseandshinemoney, talks about impulsive and intentional spending often, so here are all of her posts containing impulse purchasing related tips that I have transcribed into lists.

Keep a running list of all the things you want in your phone. Every time you feel an impulse to buy something or something new comes on your radar that you absolutely want, write that down! It’s kind of like filling up your shopping cart online, but you’re a little less close to the edge. No guilt or shame here! The list can be as long as you want.

Make the categories relevant to you! Our spending and values are all so unique, so make sure your list represents the things you care about. The idea is to feel good about your purchases before, during, and after. I break mine into categories: home, clothing, health, beauty, jewelry, tech, books.

Don’t go out and buy the thing unless you can really afford it (meaning you are taking care of your other financial goals as well). These are the things you can buy if you still want them when you work them into your spending plan.

Having money allocated to them in your spending plan means you can spend guilt-free, knowing that you CAN afford the purchase while meeting your other goals, whether that’s paying off debt, saving, investing, etc.

This way, when you have discretionary money available, you can look through the list and see which things you really want (especially if they’ve been on the list for a while). This way, you are more likely to buy things you will be satisfied with, rather than impulse purchases you don’t actually value. Putting things on the list rather than impulsively buying also gives you the ability to time your purchase with when that thing goes on sale.

Review your list maybe once a month and put a little emoji next to any that you have changed your mind on and don’t want anymore, or that you just don’t want as much as you initially did. It’s amazing how many things on the list might be things you just got caught up in wanting, but don’t actually really value.

Rather than just delete them from the list, keep them in that note so you can give yourself evidence that sometimes you think you really love/want/need that thing and it turns out with time and space that you’re fine without it!

Check the box next to any that you actually did buy and move them to a list at the bottom. Keep this list here rather than deleting it because it shows a whole record of the things you bought intentionally. When I look at mine, I feel happy knowing thatt hose things were thoughtfully purchased guilt-free while I was working on my other financial goals.

One thing I used to do was write out how I spent my money each month. Then, I would put a smiley face next to every transaction I felt really good about and star the ones I didn’t fully feel satisifed with. The next step was to figure out why the starred ones didn’t feel satisfying.

Over time, the list started having fewer stars and far more smiley faces. I was slowly aligning my spending with my interests and values, using my money in ways that felt good not just in the moment, but also in retrospect.

When I first got serious about paying off my debt by condensing an 11 year timeline into a 2.5 year timeline, it was emotionally challenging to start telling myself no.

It felt restrictive at first to stop spending in some of the ways I used to spend and while debt payoff momentum was exhilarating, my world also felt like it was getting smaller.

Reminding myself that this wasn’t forever was hugely helpful. It wasn’t that I could never spend on these things again, but just not right then. I wanted to put that money toward a bigger vision that would ultimately bring me closer to financial peace and prosperity.

Now that I have achieved that goal, I have been able to add more of that fun, discretionary spending back in. These days, when I spend, it feels so good! I know my needs are covered, my debt is gone, and it’s in my plan to have flexible spending for fun things that bring me joy.

The funny part is now that I have learned to be more mindful with spending, some of the old ways I used to spend money don’t appeal to me anymore. Now, I have even more money to either save or put towards high quality or special things that previously felt out of reach.

I hope the phrase “not never, just not right now” gives you comfort in the transition to spending less when you have a big financial goal you’re trying to reach. There is light on the other side and you really are giving yourself an incredible gift when you pursue financial peace, whatever that means for you.

A lot of us have this sense that when we want or need things, we need them right now! Sometimes that is true, but it’s worth pausing and considering if we even an overall need is something you have to get at that exact moment.

When you have to have something immediately, it doesn’t give you much time to shop around, look/wait for sales or deals, or find cheaper options.

For example, my phone started malfunctioning a month or so ago. It wasn’t sending/receiving all texts and the video was wonky. Long term, this wouldn’t work for my work or personal life.

Instead of immediately going out and buying a phone (paying upfront or putting it on a tab), I decided to use an old iPhone 6 I had for the interim while I looked for a good deal.

I am aware that not everyone has an old phone they can use, but I bet many of us have someone in our network we could borrow from until buying. Going on an iPhone 11 to an iPhone 6 was wild though… new phones have come a long way!

My plan was to buy a used phone off marketplace. This is what I always do since they seem to last as long as new phones anyway. So I needed to wait until a good deal came up, not just take the first thing available.

I also wanted to see if there would be any good deals through my phone company for Black Friday. I ended up getting an iPhone 11 Pro Max with 96% battery health for $400CAD, which is perfect for my needs.

My takeaways: Yes, I needed a phone but didn’t need a new phone right then. Not buying right away helped me be more discerning about which phone I bought and allowed me to wait for a good deal.

Be clear on your rich life! I wanted an iPhone but beyond that I don’t care about having the latest model. I honestly would have stuck with the temporary iPhone 6 if the photo quality wasn’t like 120 pixels. I need to be able to take higher resolution photos and videos for work.

creating sustainable systems ⋆˙⟡

It is important to create systems for different situations. Here are some systems that I frequently find myself in and how I’m going to address each one — feel free to use them as inspiration or a guide with situations you tend to find yourself in: 1) you’re dealing with a difficult personal/professional situation that affects your emotional state, 2) you feel like you’re starting to get influenced by social media, 3) you find yourself comparing what you own with other people, either on screen or in real life, 4) you’re bored, 5) you haven’t purchased non-essentials in a while and you just want something new, and 6) you’ve started purchasing non-essentials and can’t find a way to stop.

You’re dealing with a difficult personal/professional situation that affects your emotional state.

The one thing I struggle with the most when I’m angry or inflicted an intense emotion is that I tend to lash out or do something impulsive, whether it’s hurting someone using my words or hurting my wallet by making a bunch of non-essential purchases. I created a coping strategy in Notion that lists a series of steps that I need to follow, and so far, these steps have prevented me from doing impulsive actions. If I forget to follow them, I tend to go straight into the impulsive action and regret it immediately afterwards.

You feel like you’re starting to get influenced by social media.

Knowing me, if I don’t want to delete Instagram or other means of social media, I simply won’t. However, I have the power to change my algorithm. All it takes is marking certain posts as “not interested” or “do not recommend channel”, and purposefully watching videos that will prevent my hyperactive brain from actually convincing myself that I need this (insert non-essential item) right now.You find yourself comparing what you own with other people, either on screen or in real life.

Talk to my friends and give myself a reality check. I’m fortunate to be surrounded by people who I can actually say, “So, I’m feeling quite insecure about my finances and I feel behind, compared to you/other people.” I’ve had this conversation with Mr. Beans many times, because he is generally more financially independent and wealthy than I am (his field naturally pays much more than mine).You’re bored.

This is a nuanced reason, primarily because as a working adult, there’s no such thing as “being bored”. There will always be something to do, where it’s washing the dishes, doing the laundry, filing a reimbursement claim, throwing out moldy food… the list goes on. When I say bored, I mean “I want to ignore all my responsibilities and potato in bed all day, while online shopping.” And the solution to this? To organize my to-do list into easy, medium, and difficult tasks. I love checking tasks off my list because it gets me into a momentum, and once I have more energy, I’m able to address the more difficult, energy-requiring ones.

You haven’t purchased non-essentials in a while and you just want something new.

Read all the posts I’ve made regarding my goals. Considering that these posts, both on Substack and Instagram, are all public, I have the responsibility to be as rightfully human as possible to the people who follow me — someone who makes mistakes, but takes the time and effort to learn from them. It’s okay for me to want something new, but at the same time, it’s not okay for me to forget to add an item into my wishlist tracker, the 48-hour rule (wait 48 hours before revisiting the item to figure out if I still want it or not), and pre-fund my “non-essentials” budget category to ensure that I can actually afford the item. After these steps have been taken, I need to be creative with what I already own — if it’s clothing, I need to start experimenting with different combinations of clothing or thrift new items from my mom’s wardrobe (she’s always happy to let me borrow). I also need to revisit my Intentional Buy tracker and remind myself that it’s important to buy and own as many “best” purchases as possible. If there’s any risk for an item to be marked as worst purchase (i.e., lack of product reviews, poor return policy), then this is even a greater reason for me to refrain from purchasing said item.

You’ve started purchasing non-essentials and can’t find a way to stop.

This situation is quite relevant as I recently experienced it. What really helped me was looking at all the purchases in my Intentional Buy tracker. Realizing that I’ve already purchased 14 items and spent $1,267.02 before March is even over is pretty humbling.

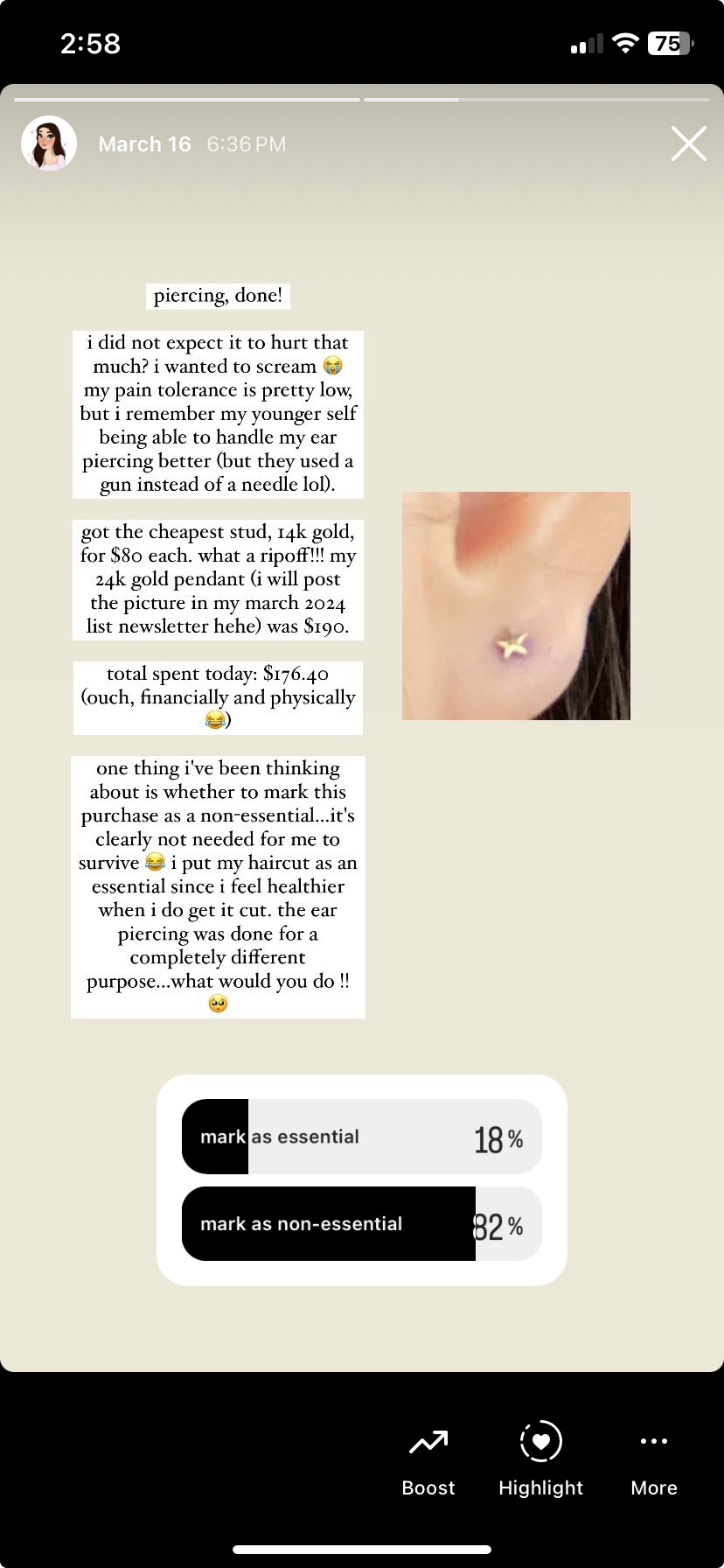

I didn’t plan for my ear piercing to be a part of my non-essentials, but in order to treat this list as fair and unbiased (?) as possible, I appreciate you all voting truthfully! (April update: had to get these taken out, so this was a big money drain. At least I now know to never ever get a piercing because getting my ear reinfected and having to go to the ER was hell.)

spending challenges and fit ⋆˙⟡

Is an intentional, low, or no buy right for you? I’m currently doing an Intentional Buy, my rendition of a “Low Buy”, that allows for more grace with spending and shifts the intention of this challenge to focus on bringing things into my life that add value instead of trying to cut down. I will explain the differences between each challenge, and the different goals that each is best suitable for.

✮⋆˙ The Intentional Buy Challenge was created by yours truly, and is guided by the idea that your actions, thoughts, and relationships should exist in your life with careful curation and purpose. The purpose of this challenge is to help you understand what brings purpose and joy into your life, rather than focus on what clutters it. This challenge is best if you:

…are still trying to figure out how to align your values with your spending habits.

…know you want to buy stuff this year, and have no issue with the idea of spending. However, it is the quality and type of spending that you would like to focus on.

…feel like you financially comfortable, yet you want to eliminate the unnecessary excess from your expense sheet

✮⋆˙ The Low Buy Challenge focuses on purchasing “as few unnecessary items as possible but there are no restrictions on what you can buy. You can set certain rules for yourself such as “I will purchase X items of clothing” but the idea is to reduce your number of purchases.”1. This challenge is best if you:

…are good at choosing items that bring you joy

…have a system in place to know whether an item aligns with your values or not

…want to focus on decreasing the volume of purchases over the quality of purchases

✮⋆˙ The No Buy Challenge cuts out all extraneous purchases and solely focuses on the essentials. This is the most strict, rigorous, and unforgiving challenge out of the three. This challenge is best if you:

…want to drastically cut down on your spending and material possessions

…are in (bad) debt and struggling to pay it off

…are new to financial literacy and want to get your finances in order

…enjoy “cold turkey” challenges that are the most restrictive but if successful, most rewarding

If you’re not entirely sure which challenge to pursue and are stuck with the semantics of each, I’d suggest creating your own challenge, like what I did with mine. If you want to do a low buy for the first month, then a no buy for the second month, and an intentional buy for the third, then do it. Do what interests you the most, and stick to it, for at least a month at a time.

the resources

Some of my favorite resources to aid in making more intentional purchases over impulsive ones.

My Notion Wishlist Tracker ($2.99)

It’s no surprise that this is the first resource I’m going to list here. However, this post will be the first time showing you, screenshot by screenshot, every view in my personal wishlist tracker. There are many reasons why I’m using Notion over any other platform to store all my wishlist items, but the main reason is that I wanted to be able to add more details without taking up an entire page of space, more functionality, and less clutter.

On the left hand side in the blue callout box, I jotted down some succinct intentions (values, even), to remind myself that this is what I need to lead my purchases with.

Right below the box is a database containing the status that each item belongs to and the sum of all the items in each status. “Still thinking” contains all the items that are currently in my wishlist. As you can see, my wishlist is worth a whopping $13K. “No” contains all the items I realized I didn’t want anymore—I love seeing this number, because in a way, I saved $24K as a result of not impulsively spending. “Yes” contains items that I ended up purchasing.

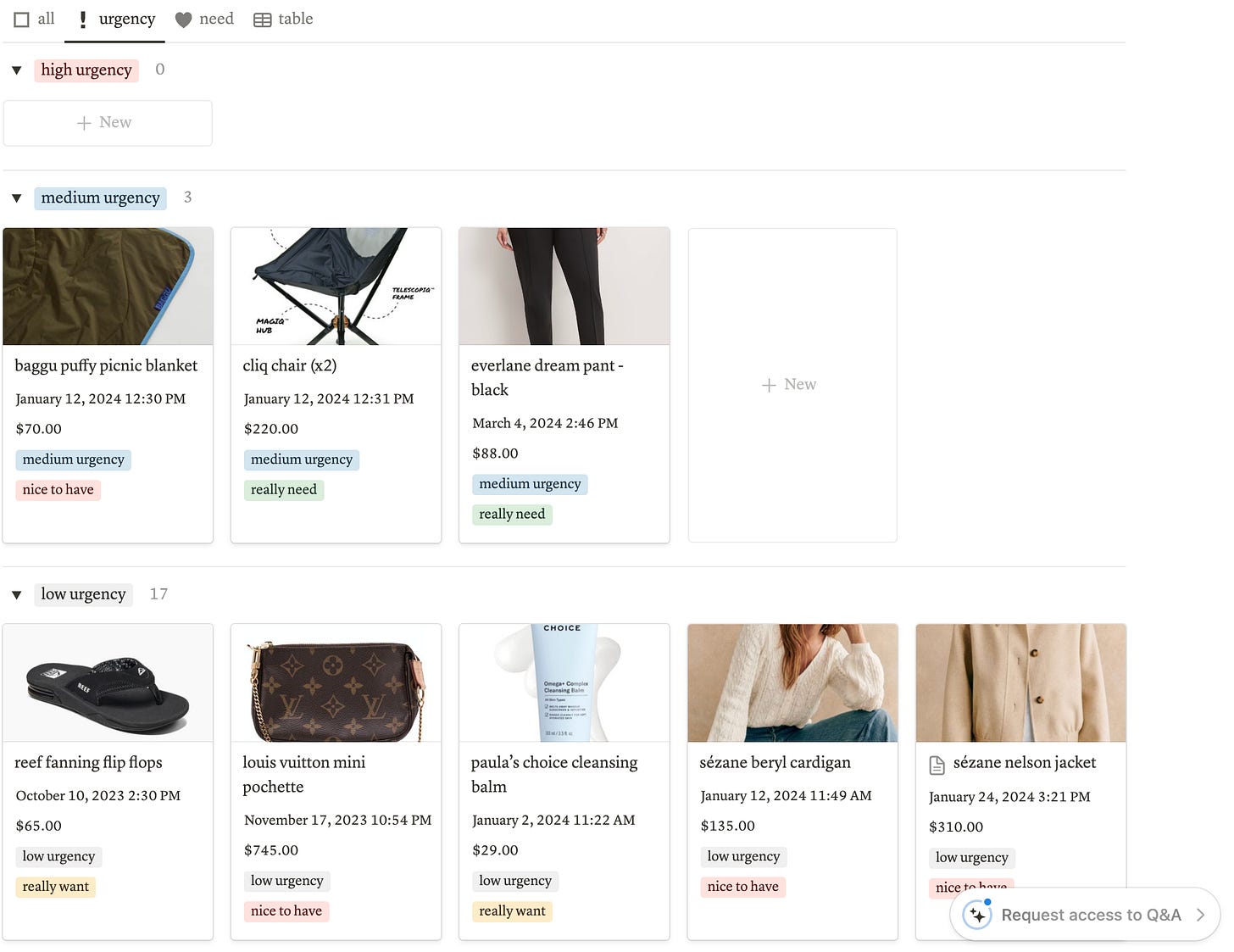

The table that takes up majority of the screenshot is a gallery view of my wishlist that is filtered to show only the items categorized as “still thinking”. This is the view I prefer to see majority of the time. I love being able to see the date the item was added into my wishlist, the level of urgency (low/medium/high), and the need level (nice to have/really want/really need/buy it when I got $$).

This is the item specific view once I click on one of the items in the table seen in the first screenshot. The date is already populated, and something I love about Notion is that if I added this directly into the table from the first screenshot, because the filter applied is “still thinking”, this new item automatically gets labelled as “still thinking”. I recently went into a Byredo store and after smelling Mojave Ghost, I knew this was going to be my next perfume/scent of choice after I empty my current perfume (Maison Margiela’s Early Sunday Morning). However, it doesn’t make sense for me to own more than one perfume, since it already takes over a year for me to empty a bottle. I also don’t like owning duplicates of beauty items.

The “group” function was game-changing when Notion released it two (?) years ago. This is the urgency view, where I’m able to see all the items visually categorized into high, medium, and low urgency. I rarely have items in the high urgency category, because I have both an emergency fund and a cushion in my budget, so I’m able to cover something that is immediately needed without having to add it into a wishlist. If you are currently building your emergency fund or aren’t able to implement a cushion budget category, then I highly recommend you take advantage of the high urgency tag and review this list often so you know which items to prioritize and save up for.

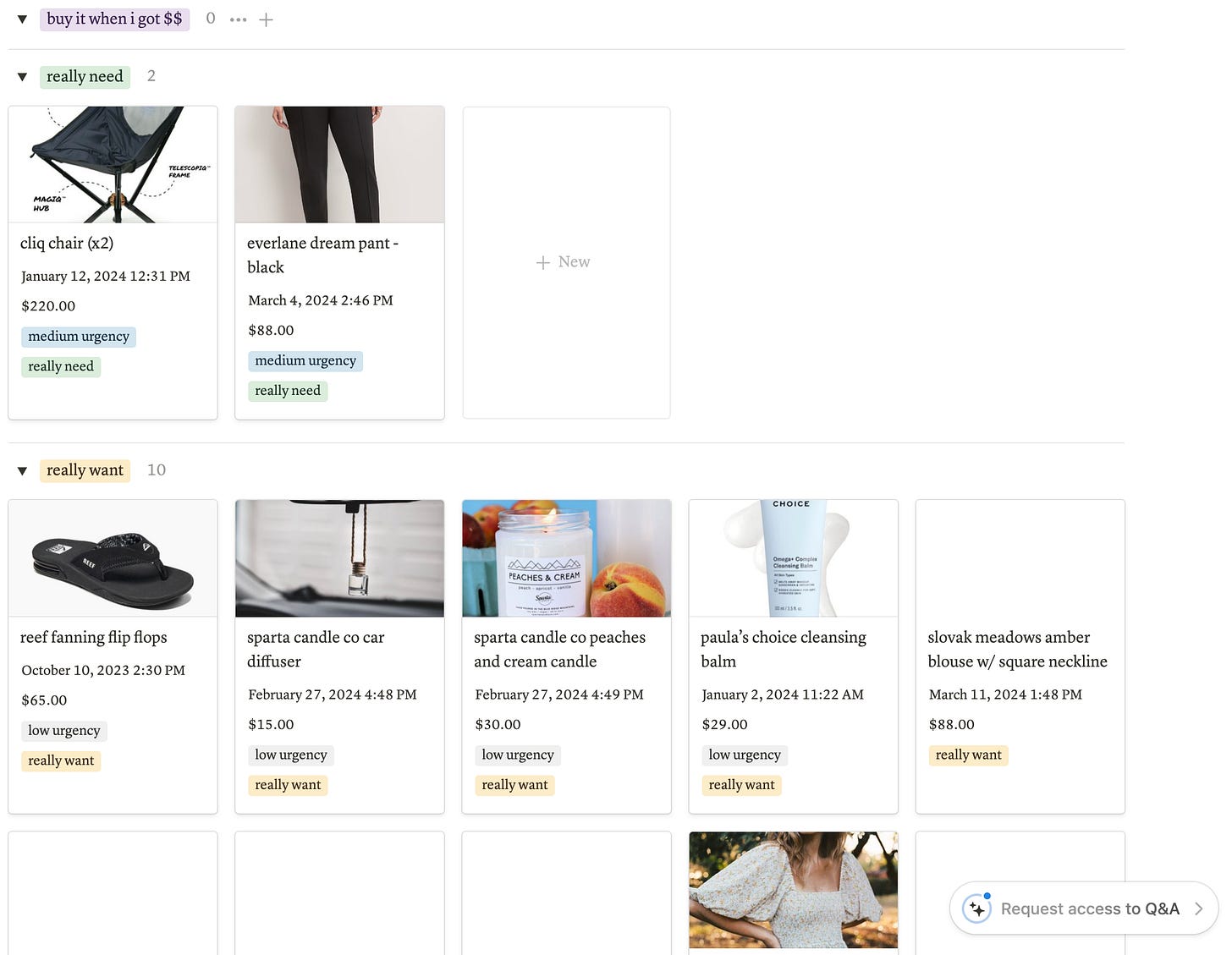

This is how I define whether I need an item or not, using the same Notion grouping function as above.

Buy it when I have $$. These are items that have been in my wishlist for more than a month, and I still really want them. These are items that I’m ready to start creating sinking funds for in my budget.

Really need. These are items that would greatly benefit my life if I were to have; however, I can’t justify putting aside money for them if I want to prioritize other financial goals (i.e., travel sinking fund, retirement, investing).

Really want. These are items I really want, and was probably close to actually clicking on “check out”. However, something stopped me from doing so (whether it’s lack of money in budget, life circumstances, etc.), and the desire to purchase is still teetering on the edge.

Nice to have. These are items that I think are really interesting, pretty, or useful, but I don’t have any desire or urge to purchase them in that instance. It’s more of a “oh, what a pretty pattern for a dress” instead of a “I need that dress right now” type mentality. Most of the time, items in this category don’t get purchased.

My Notion No/Low Buy Template ($3.99)

It is so important to track your non-essential spending as you make them, no matter how exhausting it might be (the reality is that it isn’t! stop making excuses!). Last year, I made the terrible mistake of allowing myself to be lazy and forgetting to track these items, ultimately causing me to have to go through PDFs of credit card statements and email receipts to compile a list of all the non-essentials I purchased. That’s not happening anymore this year and onwards! Of course, what better way to do this than a Notion template of course? Let’s take a tour of mine:

At the very top, I have two callout boxes where I wrote down my guide (general guidelines to follow) and intentions (my values and reasons why I’m pursuing this challenge).

These are my green, yellow, and red light rules. I like to add a toggle underneath each one with some notes, especially if I purchased from that category. As you can see above, I added notes for clothing in red — this is a visual reminder that I’ve broken my initial clothing rule.

These are my purchasing progress totals (a new addition to my personal template — this doesn’t exist in the Gumroad template, only because not everyone is going to have a set number of items for their challenge). My goal is to purchase no more than 36 items this year, and for things to be relatively consistent, I would average 3 items per month. However, as you can see, I’ve surpassed this and therefore, am not allowing myself to purchase anything until May.

I like viewing items by month because time can be an important indicator when analyzing spending patterns. Of course, there are anomalies (like this year), but when that happens, there’s always an explanation or trigger to why the pattern has shifted in an altered state.

This view is the most humbling, because the goal of the Intentional Buy is to not have any “worst” purchases. As you can see, I made 2 worst purchases, and while I’m not beating myself up over it, it is a learning lesson for me to understand what not to do moving forward (in this case, no more purchasing from companies with a poor return policy, especially if I’ve never purchased from them before; no more experimenting with different types of clothing until I’ve tested it out in-person — find similar styles at physical stores near me).

The category view allows me to visualize how many items per category I’m spending the most on. At this moment, it’s clothes. I’d like to make this distribution more balanced, but ultimately, it’s not that terrible if I end up occupying these boxes with clothing items I actually love.

If you’re not reflecting on your spending, then what are you doing? Have I taught you nothing? (Kidding, but not really). Reflecting is the most important thing that you could do for your own self, whether it be financially, emotionally, physically, spiritually, and more. It provides a lot of insight as to what you’ve learned, what you perceive are wins or losses, and how you could adjust according to your current lifestyle and/or needs!

r/nobuy Subreddit

I love this Subreddit whenever I want to see how other people are doing on their no buy journeys. This might be the best Subreddit (personally for me) to curb impulse spending, because when I see how other people are refraining from buying items they would normally buy without this challenge or certain rules in place, it motivates me to put my credit card down and rethink my decision to make the purchase. It’s great because people will post weekly or monthly updates, and it makes you feel like you’re a part of a greater community!

Grace Nevitt’s YouTube/Discord/Substack platform

I adore Grace’s content! I came across her low buy videos on YouTube, then found her Instagram, which then led me to her Discord server. She also has a Substack —

.

YouTube videos

I am aware that this is a vague resource, but that’s because I watch different videos based on the type of mood I’m in. Here are my go-to search terms and favorite videos:

No/Low Buy Rules.

Minimal Apartment/Home Tour.

Capsule/#-Item Wardrobe Tour.

Items I Don’t Purchase.

Anti-Hauls

De-Influencing

If you got to the bottom of this post, thank you, thank you, thank you. Here’s my weekly virtual hug to you, and I hope to see you back here next week.

—Beans ⋆˙⟡

Where to find me: Instagram | Goodreads | Letterboxd | Notion Templates | Wealthfront

How to Plan a Low Buy/No Buy Year. (2021). Uncomplicated Spaces. https://uncomplicatedspaces.com/how-to-plan-a-low-buy-no-buy-year/

Saving this for future reference! I participate in Tiffanie Darke's "Rule of Five" campaign last year (basically only buying 5 new items the whole year) and it forced me to create buffer time between coveting something and actually purchasing it. I had to analyze each individual clothing purchase in detail...because my next purchase wouldn't be for another 2 months! Now I feel like I'm in a really good place of noticing gaps in my wardrobe and prioritizing filling those before I buy a wish item that might not get as much wear. I also REALLY enjoyed Haley Nahman's essay this past Sunday about personal style (https://substack.com/inbox/post/143545653). Her observations that a well-curated wardrobe is one that's acquired OVER time and that our style might actually suffer if we rush to buy things are so spot-on.

Also looking at your 2 "regret" purchases--have you looked into listing on Noihsaf for money or on the lucky sweater app, which is for "slow fashion" swaps?? Obviously the most ideal purchase is one that we never regret, but recouping some of the loss by passing an item on to another slow fashion enthusiast in exchange for most of your money back or a different item is exciting and Lucky Sweater in particular feels like it has a wonderful community around it. Thought I'd mention these in case they're not on your radar :)

Stumbled here and wow! This was an incredible post and brings a lot of perspective into purchases!